Crosscurrents

With the introduction of the COVID-19 vaccines in late 2020, the equity markets quickly took stock of the changing relative investment opportunities. That is, companies and sectors left by the wayside during the period of unprecedented uncertainty were suddenly given new life. In the first six months of this year, the top-performing sectors within the Russell 2000 index were energy, basic materials, financials and consumer discretionary.

In Canada, the energy sector has experienced significant gains as well. All of these sectors were particularly harmed by the COVID-19 pandemic, but have significantly improved outlooks given the effectiveness of the vaccines and the resulting opening of many major economies. Therefore, Pembroke believes the race higher in the underlying share prices of many of the businesses is justified.

However, with this reasonable “reflation trade” now well documented, the question becomes whether the world is facing a prolonged period of inflation or whether the structural problems caused by demographic challenges, huge government debt burdens, technological advances that have marginalized large swaths of the labour market, and globalization will continue to weigh on growth.

With confidence growing that the worst of the pandemic is behind many OECD nations, the market’s focus returned late in the second quarter to these concerns. Further, the challenges posed by COVID-19 are far from over. New variants are concerning medical experts, and many countries have weak or ineffective vaccine campaigns.

In June, interest rates, which had been rising in anticipation of accelerating economic growth, fell from their 2021 highs and growth stocks surged as investors once again sought out companies that could grow and prosper even in a slow-growth world. Essentially, the cross-currents are unrelenting as investors weigh the excitement of an economic reopening post-pandemic against the challenges that were in place before COVID-19 ravaged the global economy and which still exist today.

Pembroke’s view is not to have one or, more specifically, not to marry one. There are so many countervailing opinions and considerations, and the COVID crisis is so new, that to take a long-term view on how this will all shake out seems unproductive and unrealistic. Certainly, COVID will not have eliminated many of the structural headwinds to economic growth listed above.

However, will new factors emerge that could aid or hurt the global outlook? Of course. With this “knowledge”, Pembroke is focused on identifying key underlying trends and businesses that it believes will flourish regardless. Pembroke’s portfolios have exposure to the incredible advances being made in biotechnology, to the changing ways consumers buy goods and services, to the application of technology to labour-intensive industries such as call centres, and to the software tackling the increased complexity of global supply chains.

The firm is also backing proven capital allocators who are consolidating traditional industries, such as landscaping to leverage the benefits of scale. In other words, the investment team is blocking out the noise and focusing on finding businesses that are growing, earning a healthy return on their invested capital, and are run by shareholder-oriented management teams. With so many unknowns, the importance of valuation and balance sheet discipline is paramount.

Outlook

Pembroke continues to focus on quality growth companies. The firm’s portfolios are largely comprised of holdings which have successfully grown through COVID and holdings which were impacted by the pandemic but had the balance sheet strength and competitive advantages necessary to meet their long-term objectives.

The investment team continues to add new holdings in both the US and Canada, a signal that opportunities which offer both compelling valuations and attractive growth outlooks exist for active investors. In 2021, the firm has trimmed some holdings which soared to new heights on the back of falling interest rates and pandemic-proof business models and reallocated that capital to more favourable risk-reward opportunities.

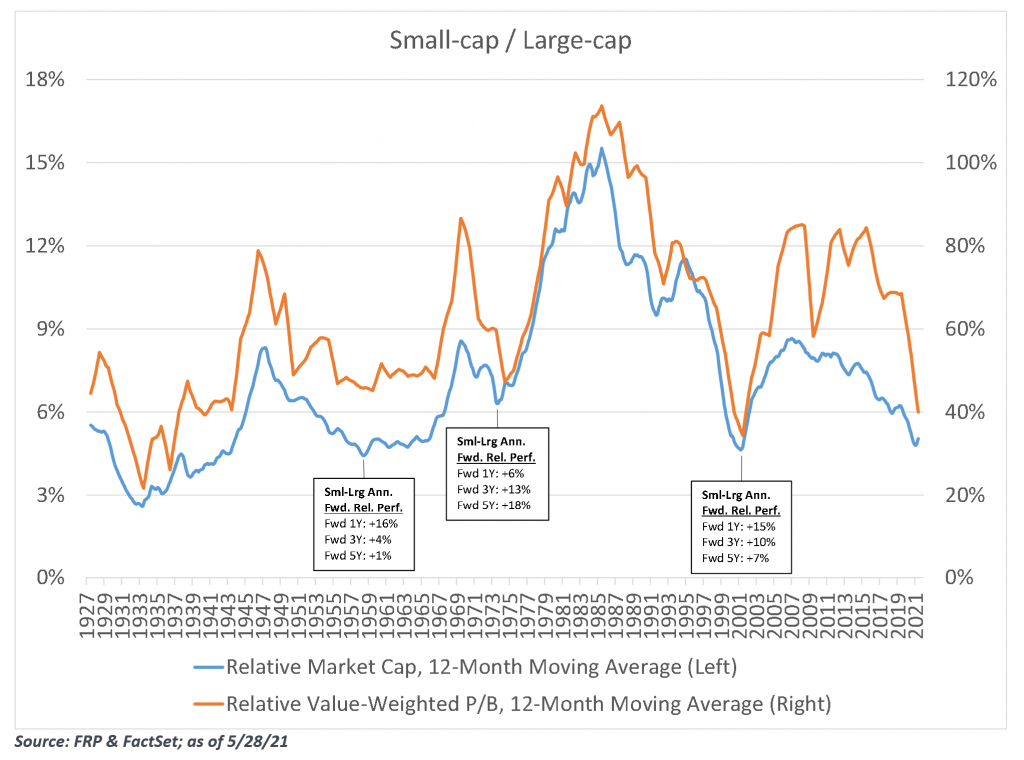

The strong performance of existing holdings, combined with these portfolio management decisions, has helped the firm deliver reasonable performance in the first half of 2021. despite lapping a strong relative and absolute year in 2020. On an historical basis, the valuation accorded to small capitalization equities is also attractive compared to larger capitalization equities, as can be seen below.

Fig. 1. Small-cap valuation relative to large-cap, using P/B, is currently near long-term lows

LEARN MORE:

- See Our Solutions page for Pembroke’s range of funds.

- Learn about Pembroke’s Investment Philosophy.

- You can also Meet the Team here at Pembroke.

Other Articles Of Interest

Disclaimer

This report is for the purpose of providing some insight into Pembroke and the Pembroke funds. Past performance is not indicative of future returns. Any securities listed herein, are for informational purposes only and are not intended and should not be construed as investment advice nor is it a recommendation to buy or sell any particular security. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Pembroke seeks to ensure that the content of this document is correct and up to date but does not guarantee that the content is accurate and complete and does not assume any responsibility for this. Pembroke is not responsible for decisions or actions taken or made on the basis of information contained in this document.