Investment Commentary & Outlook – Q4 2020

Hold Your Course

Fortune Favours the Steady Hand & the Long-term View

Seasoned investors frequently claim they have “seen it all”. Recessions, bear markets, bull markets, irrational exuberance, and irrational fear. It is all part of the normal course of business for long-term investors. Events in 2020, however, tested investors, governments, central banks, and society in ways that we hope will not soon be repeated. The result was an unexpectedly strong stock market performance after an historic fall in March.

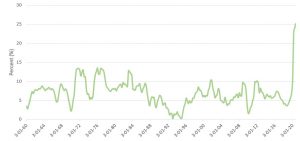

In prior issues of Pembroke Perspectives, we wrote about the collapse of equity prices in the first quarter of this year, driven by a combination of rational concerns about the economic impact of COVID-19 and inevitable investor panic. We also described the recovery in the second and third quarters of the year, driven largely by secular growth companies that were well-positioned to weather this unprecedented global pandemic. Many disruptive software companies, biotechnology businesses, and work-from-home beneficiaries saw their stock prices surge. Of course, this was not solely the result of their operating progress and growth. Central banks around the world, including the Fed, pulled out their bazookas, flooding the economy with cheap money to prop up asset prices and incentivize lending and borrowing at low interest rates (Exhibit 1).

Exhibit 1: Federal Reserve Money Supply M2 YoY % Change 1960 – 2020

Source: Bloomberg

Certainly, public equities, like many other asset classes, benefitted from this surge of liquidity. Notably, smaller companies also followed their historical pattern of outperforming large capitalization companies from the bottom of the crisis. The result was a stock rally that began in the second quarter and culminated in a fourth quarter advance in which the Russell 2000 posted its best-ever monthly return in November.

What are some of the key investment lessons of 2020?

- Timing the market is difficult…at best. Selling in March or April would have felt prudent, and at times prescient, but the stock market has a habit of surprising, and short-term directional changes can be rapid and unexpected.

- Don’t assume that current business conditions dictate stock prices. Many factors contribute to equity prices, including money supply and interest rates.

- Private enterprises can be surprisingly resilient and adaptable. Despite an unforeseen economic shutdown, many businesses altered their operating models, reduced costs, or changed their strategies quickly enough to deliver strong financial results in 2020.

- The market looks forward, not backward. At first, investors flocked back into companies with growth and business models that would not be crushed by the COVID-19 shutdown. Then, with the release of a successful vaccine, the shares of companies that had been left for dead rebounded significantly in the fourth quarter. In both instances, prices reflected prospective fundamentals, as a return to “normal” became more realistic.

This last point brings us to the fourth quarter of 2020, which was the best quarter on record for the Russell 2000. The news that Pfizer had developed an effective vaccine against COVID-19 changed the character of the stock market’s surge. During the second and third quarters of the year, secular growth companies clearly led the way. Investors were most comfortable backing companies posting revenue growth despite or even because of the pandemic. After all, it was not always clear if or when a vaccine would be developed, so it made sense to side with enterprises effectively responding to such difficult conditions. With the release of a vaccine, investors once again looked past the current and toward the future. At the same time, the results of the US presidential election contributed to a feeling that government purse strings would loosen and help further accelerate economic growth. The combination of these factors contributed to a broader market advance than what was experienced in the prior two quarters. The share prices of companies operating in hard-hit sectors, such as travel and entertainment, surged higher. Further, shares of companies in cyclical industries such as banking and energy rose after a very difficult first three quarters of the year. In other words, “value” stocks joined the bull market. The broadening of the market’s advance captures optimism that sometime in 2021, COVID-19 will be brought under control by widespread immunization and that central banks are poised to keep interest rates low and money supply ample.

Pembroke’s managers share this generally optimistic view. Nevertheless, uncertainties about the timing of an economic recovery abound, and certain consumer habits and business practices have been forever altered. Examples of changes include:

- Work-from-home. While many workers will return to the office, the effective use of technologies that allow for more flexible work environments will continue to grow over time.

- Online consumerism. Forced to deal with COVID-19 lockdowns, businesses ramped up their investment in online front and back-ends, making it easier than ever to order anything from furniture to dinner right to your door.

- Software-as-a-service. The remote implementation and hosting of software were already growing rapidly, and the pandemic accelerated the trend to new heights.

- Home care and telemedicine. Fewer people will opt to receive care in a crowded nursing facility if the same treatment can be provided in the safety of their own home. Similarly, more doctors than ever are now equipped to meet patients virtually, avoiding the hassle of in-person visits and the risks associated with waiting rooms.

- Electronic payments. While cash continues to be important in many transactions, COVID-19 forced a wide range of businesses to implement cashless payment options for consumers as well as for business-to-business payments.

COVID-19 accelerated many trends that were already underway . We do not expect the genie to go back in the bottle and expect many “old-line” businesses and products will continue to come under significant pressure. Virtual meeting technologies will clearly impact future travel demand in ways we cannot yet predict. Work-from-home will change the way people invest in their homes and might lessen demand for office space in downtown cores. Patients will come to expect virtual appointments with their doctors. “Cash only” businesses will be fewer and farther between. And most importantly, the economic recovery might take longer than expected after the devastation caused by the pandemic, either because the damage has been even worse than currently assumed or because the vaccine rollout is not as fast or effective as hoped.

As a firm, we aim to position our portfolios in companies that will benefit from changing behaviors and new technologies. In the software industry, Pembroke holdings that are helping hospitals with supply chain management, upending the moribund database market, and providing novel payroll solutions all performed well despite COVID-19. At the same time, the investment team remains committed to a balanced and diversified approach to portfolio construction, with the view, long maintained, that growth companies need not operate in traditional high-growth industries. We enjoyed success in 2020 with companies operating in diverse areas including recreational activities, landscaping supply, automotive climate technology, healthcare research, and consumer packaging. Our overarching objective is to identify well-run companies with strong competitive advantages that are growing into large long-term market opportunities. We want businesses that are generating excess cash while funding their growth ambitions. Most importantly, given the uncharted waters in which we find ourselves, we remain focused on balanced sheet strength. If the economic recovery process proves longer or more difficult than currently expected, we want to know that our companies have the means to survive or to even gain market share during challenging periods.

While we are pleased that many of our holdings posted strong results during the past year and that central banks seem poised to maintain policies that are generally accommodative to stocks, we do not underestimate the risks associated with the exploding government debt, rapid changes to social norms, and possibilities for political unrest resulting from COVID-19’s impact. We believe that innovative market-leading companies with superior solutions, strong balance sheets, and growth opportunities, will continue to offer capital appreciation potential but also provide defense against the risk of permanent capital loss in this uncertain and rapidly changing environment.

Outlook

Few investors would have predicted the stock market performance of 2020 after COVID-19 struck western economies in March. Certainly, aggressive actions taken by various governments and central banks to prop up their economies contributed significantly to the market’s rise. At the same time, some corporations benefitted from powerful underlying trends accelerated by the pandemic, and others proved amazingly adept at re-positioning their businesses for the new reality, no matter how temporary it is. One of the major risks faced now is whether the market has gotten too far ahead of fundamentals. Essentially, will companies be able to meet lofty expectations for 2021 and beyond? Making those short-term calls is not Pembroke’s focus. There are pundits who make articulate cases for a stock market correction, and others who point out that strong returns are often followed by more strength.

At a portfolio level, Pembroke is confronting these challenges by maintaining discipline on:

- Valuation: several large holdings that have benefitted from significant valuation expansion have been reduced in weight to reflect their diminishing upside potential and rising risk of downside.

- Balance sheets: the portfolio managers closely monitor holdings’ balance sheets to ensure the companies have the flexibility to navigate a difficult economy.

- Diversification: Pembroke seeks growth opportunities across a broad range of industries, from technology to banking to housing.

Pembroke recommends that families and institutions alike maintain a long-term view. The opportunities in front of many of our holdings remain as compelling as ever. In the case of some, they have the chance to develop into the next generation of household names (or at least, stock market winners) based on their competitive advantages and strong records of execution. Will they be rewarded for their progress in 2021? Potentially yes, but potentially no. We are confident however, that if the companies can meet their growth objectives while maintaining financial discipline, patient investors will be better off taking a long-term view than trying to time markets. At the same time, a measure of diversification is reasonable for investors seeking a more balanced return profile, and Pembroke has the solutions to help clients assess and meet their investment objectives.

- See Our Solutions page for Pembroke’s range of funds.

- Learn about Pembroke’s Investment Philosophy.

- You can also Meet the Team here at Pembroke.

Other Articles Of Interest

Disclaimer

This report is for the purpose of providing some insight into Pembroke and the Pembroke funds. Past performance is not indicative of future returns. Any securities listed herein, are for informational purposes only and are not intended and should not be construed as investment advice nor is it a recommendation to buy or sell any particular security. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Pembroke seeks to ensure that the content of this document is correct and up to date but does not guarantee that the content is accurate and complete and does not assume any responsibility for this. Pembroke is not responsible for decisions or actions taken or made on the basis of information contained in this document.