The Pandemic as Accelerant

Our On the Road series takes a wide-angle view this quarter looking at the bigger picture

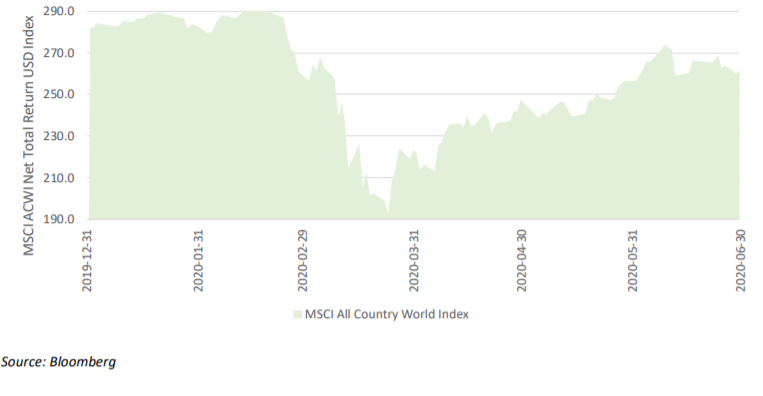

It is the nature of crashes that they occur suddenly. Looking back on the first half of 2020, it is nevertheless, hard to find historical precedent either for what has taken place in the global economy and world stock and bond markets, or how quickly it has transpired. The MSCI All Country world Index (ACWI), one of the broadest indices of global stocks, gives a sense of the scale and proportion of events. At the end of 2019, the index had a market capitalisation of a little over USD 50 trillion, equivalent to about 57% of 2019 global GDP of USD 88 trillion.1

From February 17th to March 20th, the index declined 34%, a loss in value on the order of USD 17 trillion in 25 trading days. By the end of the second quarter, the index had returned to within 6% of its beginning-of-year level (Exhibit 1).

Exhibit 1: MSCI All Country World Index Performance During First half of 2020

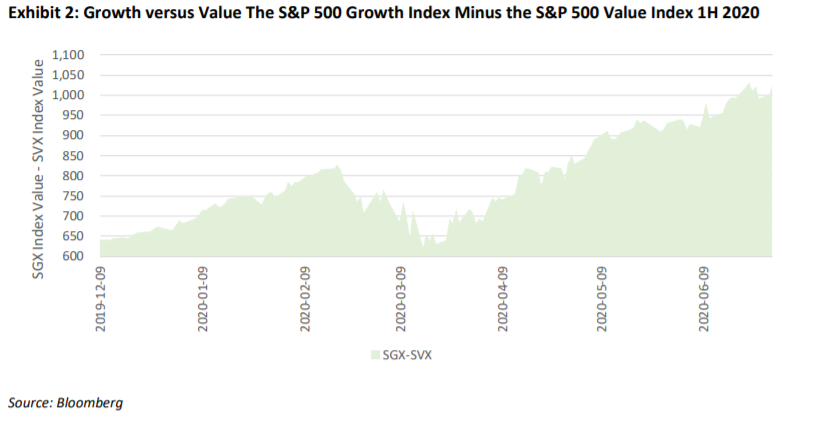

The remarkable recovery in the ACWI’s market value, however, belies tectonic share-shifts that have taken place within it. Technology, whether it is under the hood of our cars, supporting our virtual meetings and conferences, or managing the supply chains of e-commerce, is disrupting incumbent businesses at an accelerating pace. The ACWI information technology sub-index gained 14% in the first half of 2020. By contrast, the ACWI energy sub-index lost 34%. There are indications that this is but one of the many systemic changes underway. Toward the end of the quarter, one of the world’s largest integrated oil and gas companies BP p.l.c., shared their view that the aftermath of the pandemic could “accelerate the pace of transition to a lower carbon economy and energy system…”2. At the core of that new system the company that wants to “Power Everything”, Tesla, gained over 150% in the first half of 2020. Its market capitalisation is now nearly as large as BP p.l.c. and Exxon Mobil combined. The notion of the pandemic as an accelerant of existing secular trends was a recurring theme in Pembroke’s 2020 virtual manager luncheon series and was by no means limited to energy or technology as our portfolio managers reviewed the prospects for market share gains by innovative disruptors in online shopping, telemedicine and telehealth, and digital financial services. On the losing side of these share-shifts, though, there has been a heavy toll. Already impaired, numerous once-dominant business models in traditional consumer retail, healthcare, transportation, energy, and industrial businesses suffered permanent impairment or became distressed during the period. The violent changes in these sectors reflect a quickening and convergence of secular technological, social, and environmental trends that are rupturing established models and systems and creating market-share shifts in favor of innovative disruptors. Capital is flowing to entrepreneurs who are both in tune to society’s demands and who are successful at managing growth. One perspective on these shifting capital flows is the widening performance gap between growth and value companies While the S&P500 Value Index (SVX) lost 12% in the first half of 2020, the S&P 500 growth index (SGX) gained 12%.

One explanation for the scale and speed of capital redirection may be that market participants are increasingly recognizing the pandemic not as an event but as a wake-up-call. Covid-19 is but the latest in a series of emerging diseases including SARS, pandemic influenza H1N1, Avian Influenza, West Nile Virus, and MERS that may have been exacerbated by climate change. In May, The World Bank published Fighting Infectious Diseases: The Connection to Climate Change3 discussing the impact of changing weather patterns, air pollution, melting ice and permafrost, and global warming on infectious diseases. After months of global quarantine, travel restriction, and enforced distancing, the true sustainability of business models has been brutally tested. If it is realistic to envisage continued climate change, more frequent regional and global disease outbreaks, and more frequent natural disasters, it is realistic to envisage the continued outperformance of disruptive business models that respond to these exigencies and indeed go some way to reversing the trends behind them. Pembroke has always invested in innovation because innovation is a truly renewable resource. Companies that are relentlessly driven by new ideas are companies that can grow, respond to changing circumstances, or create their own new circumstances. In this way, innovation is at the heart of sustainability. The pandemic has demonstrated tangibly the fragility of myriad models (global food and medical supply chains, just-in-time inventories, testing and monitoring protocols, packaging and delivery systems, and fuel storage and supply systems, to name but a few). It has also shown how quickly governments, businesses, and consumers will migrate en masse to innovative alternative solutions. One of the reasons it has always been so important for Pembroke analysts and portfolio managers to go ‘on the road’ is to meet the new innovators and feel the excitement inside idea-driven organizations. While there is no substitute for this type of close-up company due diligence, there are moments as well when it’s important to recognize the wider-angle tipping points in the economy. As the summer of 2020 rolls on, it is becoming clearer that the economic toll of this pandemic is not going to be temporary. The pandemic is instead hastening and deepening secular changes that were already underway; societal changes to the way we work, travel, consume entertainment, exercise, shop, and eat. The share shifts that have taken place in the first six months of 2020 may be only a harbinger of the new wave ahead.

LEARN MORE:

- See Our Solutions page for Pembroke’s range of funds.

- Learn about Pembroke’s Investment Philosophy.

- You can also Meet the Team here at Pembroke.

Other Articles Of Interest

Disclaimer

This report is for the purpose of providing some insight into Pembroke and the Pembroke funds. Past performance is not indicative of future returns. Any securities listed herein, are for informational purposes only and are not intended and should not be construed as investment advice nor is it a recommendation to buy or sell any particular security. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Pembroke seeks to ensure that the content of this document is correct and up to date but does not guarantee that the content is accurate and complete and does not assume any responsibility for this. Pembroke is not responsible for decisions or actions taken or made on the basis of information contained in this document.