April 2025

This is the third draft of this quarterly note. Such is the world as the Trump administration whipsaws global equity markets with news of tariffs that seem to change every day, if not every hour. What is the purpose of this trade war? To bring manufacturing jobs back to America? To force trading partners to lower their tariffs on U.S. imports? To create a recession to lower government borrowing costs? Or to isolate China?

All of these explanations have been floated by administration officials, and all are plausible. With markets sinking by the day, Trump suddenly paused most “reciprocal” tariffs, while raising them to 125% on China, then 145% the next day, and maintaining a flat 10% tax on most other imported goods. The news followed weeks of market turmoil as Trump and his team hinted at, then proposed, crippling levies on many trading partners. Investors worried that aggressive U.S. tariffs would send the world into a global recession, and stocks reacted poorly.

Company fundamentals and most other news were cast aside as “tariff mania” dominated market headlines and investor decisions. Fear is a powerful force, and the stock market is a great place to see it in action. Before the tariff pause, trillions of dollars in wealth were wiped out as people ran for the exits. Trading desks were reporting record volumes as the selling frenzy intensified.

Then came the unexpected tariff pause, and the markets soared in response. How does an investor cope with such a situation?

THE PEMBROKE APPROACH

At Pembroke, we do not claim to know how the future will unfold. Trump’s unpredictability makes us even more reluctant to make short-term market calls. Our approach to these situations is to be patient, avoid rash decisions, and ensure that all of our holdings have the balance sheets needed to withstand a potential economic downturn.

Looking at past periods of significant market declines, we can also take comfort in the fact that they have generally presented compelling buying opportunities, even when recessions have taken hold. Historically, selling after 25% declines has generally not been a good strategy. Valuations of many large companies are now near multi-year lows. So the risks investors face should not be considered without acknowledging the opportunities. After all, the current trade war is not the first crisis most of us have faced, even in the context of the current decade. The pandemic has faded into memory, but the fear in March 2020 was palpable as markets around the world crashed.

As for the Great Financial Crisis of 2008, it had business and political leaders wondering if the entire economy would collapse. The dotcom collapse of 2000, the stock market crash of 1987, and the oil embargo of the 1970s also fuelled tremendous investor fear. Without exception, all of these “crises” turned out to be buying opportunities. Companies adapted. Central banks stepped in. Voters made their voices heard at the ballot box.

Each crisis was different, but none permanently halted technological innovation or economic progress. In each case, they felt terrible and frightening at the time, but are now remembered as “lessons learned” or “pieces of history.” As horrible as the current tariff news feels, it pales in comparison to the Great Financial Crisis of 2008 or World War II…

AMERICAN “EXCEPTIONALISM”

When it comes to the U.S. specifically, investors around the world are questioning whether they still want to allocate capital to American companies. Anger, frustration and confusion are natural responses to the current administration’s communications and policies. However, history serves as a reminder not to underestimate our neighbour to the south.

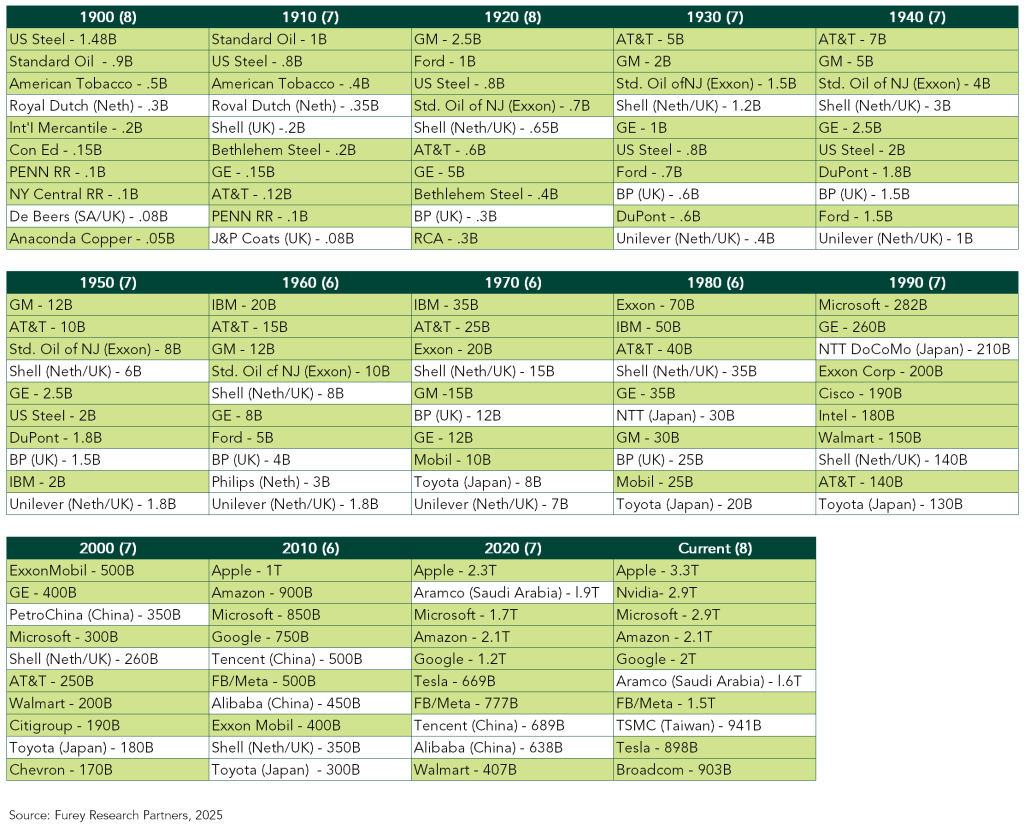

Despite periods of isolationism, warmongering, ugly politics, currency fluctuations and inflation, the U.S. economy has produced impressive companies throughout its history. As the table below shows, American “exceptionalism” has survived many different administrations and geopolitical crises. Simply put, looking at almost any decade, the number of large, innovative companies based in the U.S. compared to the rest of the world is simply astounding.

Largest Market Cap Companies in the World by Decade

EUROPE AND CANADA

Canada, meanwhile, is positioning its economy for greater independence, as politicians on the left and right compete to show that they are more willing than their opponents to reduce regulation, encourage investment, and promote interprovincial trade.

Similarly, Europe and other advanced economies, such as Japan, are negotiating with the U.S., while exploring how to expand free trade with other nations. They are also developing plans to invest in technology and military initiatives. A period of adjustment is already upon us all, and there will be companies that emerge from the current landscape to create great shareholder wealth.

At Pembroke, the investment team is currently reviewing portfolios and taking disciplined action when absolutely necessary. Its members are also looking for entry points in undervalued companies ahead of large secular growth opportunities.

We wish we had a crystal ball or special insight into the mind of Donald Trump, but we do not. Instead, we have over 56 years of investing experience and the scars, as well as the good fortune, to prove it. With that in mind, we recommend calm, a diversified investment portfolio, and trust in human ingenuity and resilience.

Other Articles Of Interest

Disclaimer

This report is for the purpose of providing some insight into Pembroke and the Pembroke funds. Past performance is not indicative of future returns. Any securities listed herein, are for informational purposes only and are not intended and should not be construed as investment advice nor is it a recommendation to buy or sell any particular security. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Pembroke seeks to ensure that the content of this document is correct and up to date but does not guarantee that the content is accurate and complete and does not assume any responsibility for this. Pembroke is not responsible for decisions or actions taken or made on the basis of information contained in this document.