December 2024

Last September, Pembroke’s investment team had the opportunity to attend the Black Diamond Group’s (BDI) investor tour in Calgary, Alberta. BDI was an investment darling in the early 2010s, but was left out in the cold when oil prices fell nearly 70% in 18 months from 2014, leading to a 90% collapse in its Earnings Before Interest, Tax, Depreciation and Amortization (EBITDA).

At the time, BDI was trying to reinvest the cash flows from its workforce solutions segment, which was heavily tied to work camps in the oil sands, into its modular space solutions segment, a more diversified modular building and storage container business. However, the decline was much faster and more severe than expected.

Rise, Fall and Rise Again

Since the abrupt fall, BDI has been working hard to improve its end market exposure, right-size its fleet in Canada, and improve its underlying economics. The same management team that was in place in 2014 is still at the helm today, and instead of unloading their shares, they have steadily increased their stake over time.

BDI’s exposure to the oil and gas industry is now below 10%, the average contract term in its modular space solutions business is now five years, and its return on assets is approaching 20%. The bottom line is that BDI is now a more diversified and higher quality company than ever before.

Firing on All Cylinders

During our discussions with management and site visits, their discipline and capital allocation skills became increasingly clear.

- They have clear return on investment hurdles, which they monitor on a branch and asset type basis using a fleet asset return matrix.

- They are extremely diligent in maintaining the quality of their assets to ensure that a ten-year-old unit can be rented for the same price as a brand new one.

- They are disciplined acquirers, ensuring the quality of incoming assets. For example, in a recent acquisition of 1800 units, only two units were not inspected because they were located at a nuclear facility.

BDI has the runway to grow its modular space solutions business organically in the high single-digit to low double-digit range over the next three years and beyond, driven by the renewal of contracts that have not yet been repriced since the recent inflationary period, disciplined fleet growth, and higher penetration of high-margin value-added products, such as office furniture rental.

In addition, this growth could be supplemented by acquisitions should quality assets become available for sale.

Lodge Link Optionality

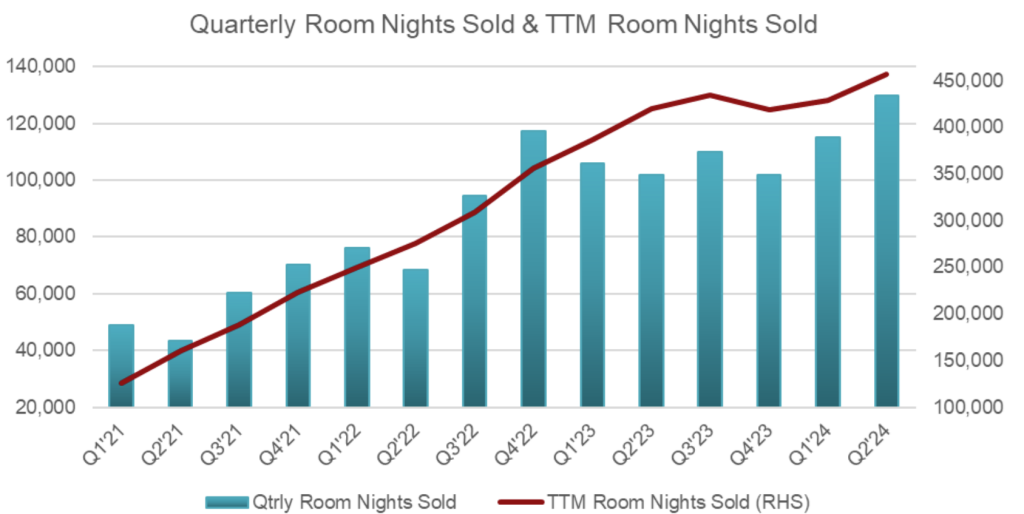

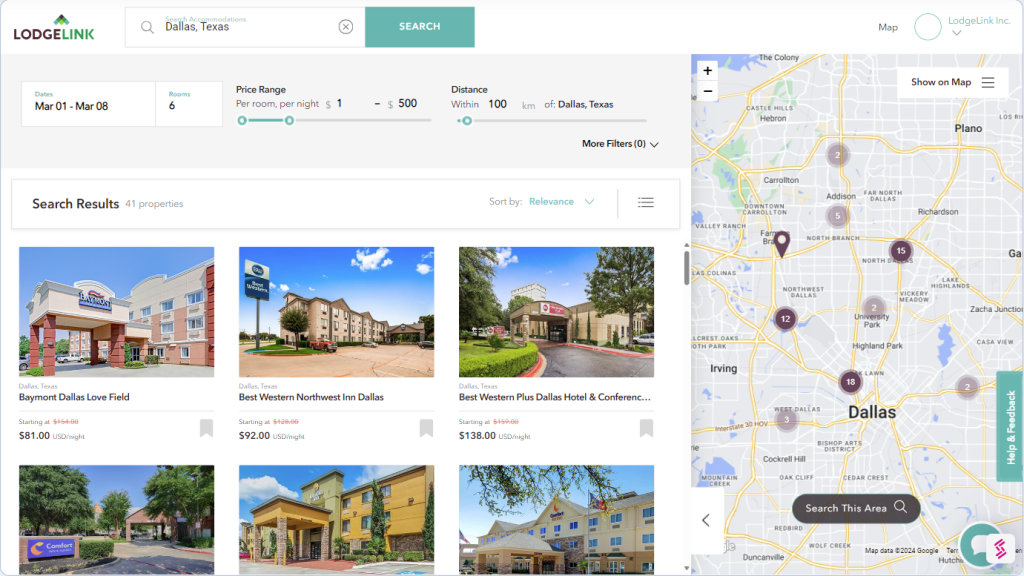

BDI’s Lodge Link started as a project for some of the company’s large energy customers on the workforce solutions side. It has since grown into an end-to-end workforce travel management solution with over 17,000 properties representing 1.6 million rooms.

Lodge Link has had the privilege of being “hidden” within BDI, allowing it to focus on the product and user experience without the pressure to maximize short-term revenue or profitability. This market has been largely underserved by the large business-to-consumer travel management companies due to the niche nature of the space and the much higher level of service required (the average booking is changed five times before the stay).

Lodge Link sells itself on the mid-office savings, aggregation and visibility it provides to its customers. It generates revenue by retaining the volume discount it negotiates with lodging providers.

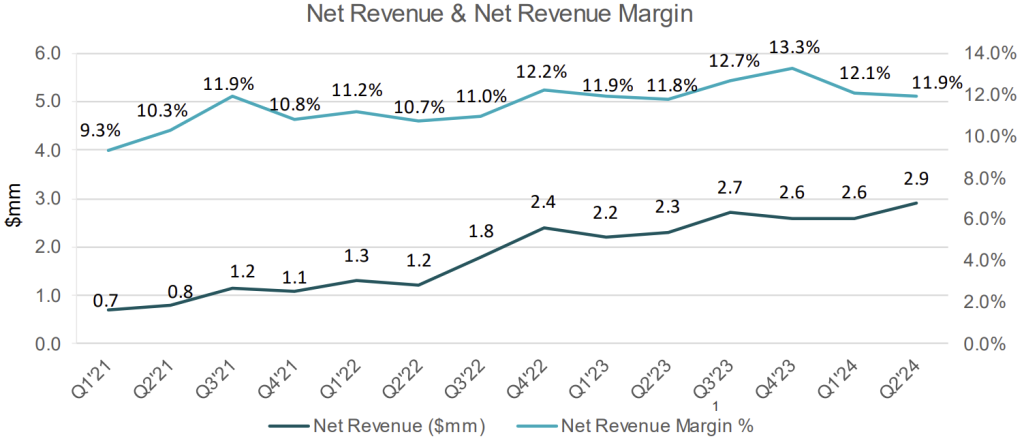

We have been impressed by the ease of use of the platform, the monetization flywheel and the back-end improvements they have made. As they scale, they can negotiate larger volume discounts and are looking to further monetize through credit card and subscription fees. They currently capture 12% of gross merchandise value, with a goal of 20% over time.

A few years ago, 70% of booking, reconciliation and administration was done manually and only 30% was automated. This equation has now been reversed and there is a target of 90–95% automation over time, with a huge leverage effect on Lodge Link’s headcount.

Investment Opportunity

Today, Lodge Link is EBITDA neutral and growing net revenues at over 25% per annum. In any potential monetization plan, it would likely be valued at a multiple of sales, unlike BDI’s core business, which is traditionally valued on EBITDA. In our view, either the market does not attribute any value to Lodge Link or BDI’s core business is significantly undervalued relative to its peers.

Despite the strong share price appreciation since Pembroke first invested in February 2023 at $5.60, we believe BDI is still in the early stages of discovery and the thesis remains as attractive as ever. Investors tend to be slow to reopen old dossiers associated with historical stigma, but there are opportunities when the story has changed.

Other Articles Of Interest

Disclaimer

This report is for the purpose of providing some insight into Pembroke and the Pembroke funds. Past performance is not indicative of future returns. Any securities listed herein, are for informational purposes only and are not intended and should not be construed as investment advice nor is it a recommendation to buy or sell any particular security. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Pembroke seeks to ensure that the content of this document is correct and up to date but does not guarantee that the content is accurate and complete and does not assume any responsibility for this. Pembroke is not responsible for decisions or actions taken or made on the basis of information contained in this document.