The Bad

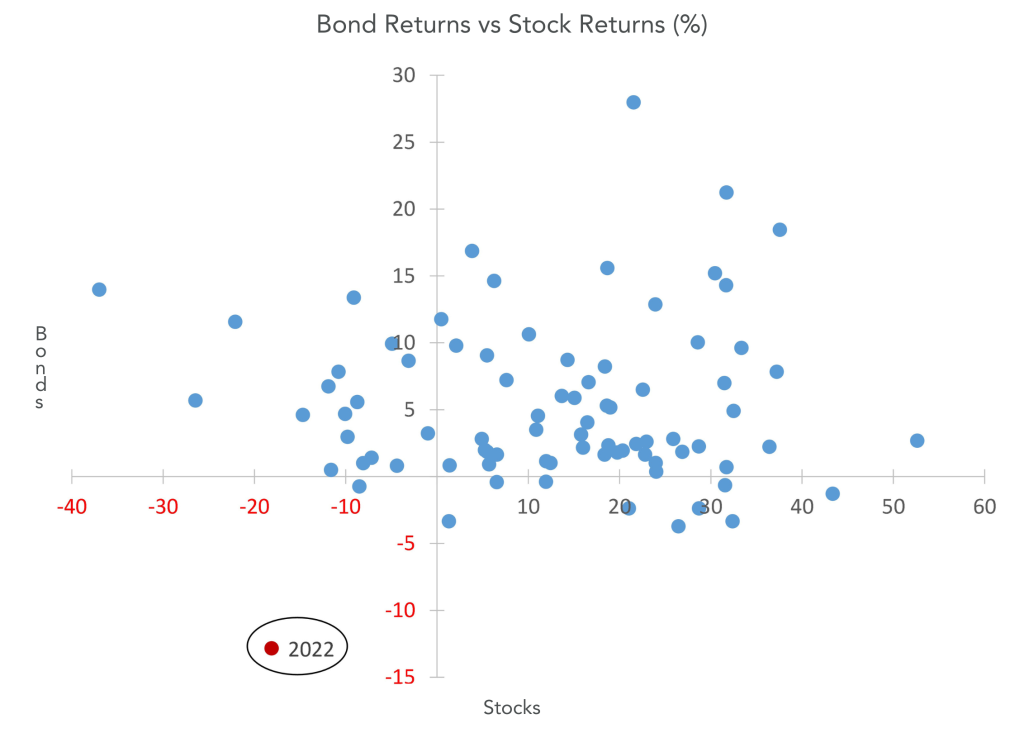

There are not a lot of ways to sugar coat 2022’s financial market results. Risk assets struggled almost across the board, as central banks aggressively raised interest rates to combat inflation. Most equities saw their valuations compress and bond prices plunged, leaving little place to hide. As the graphic below illustrates more than clearly, 2022 was the worst year since 1940 when examining both stocks and bonds.

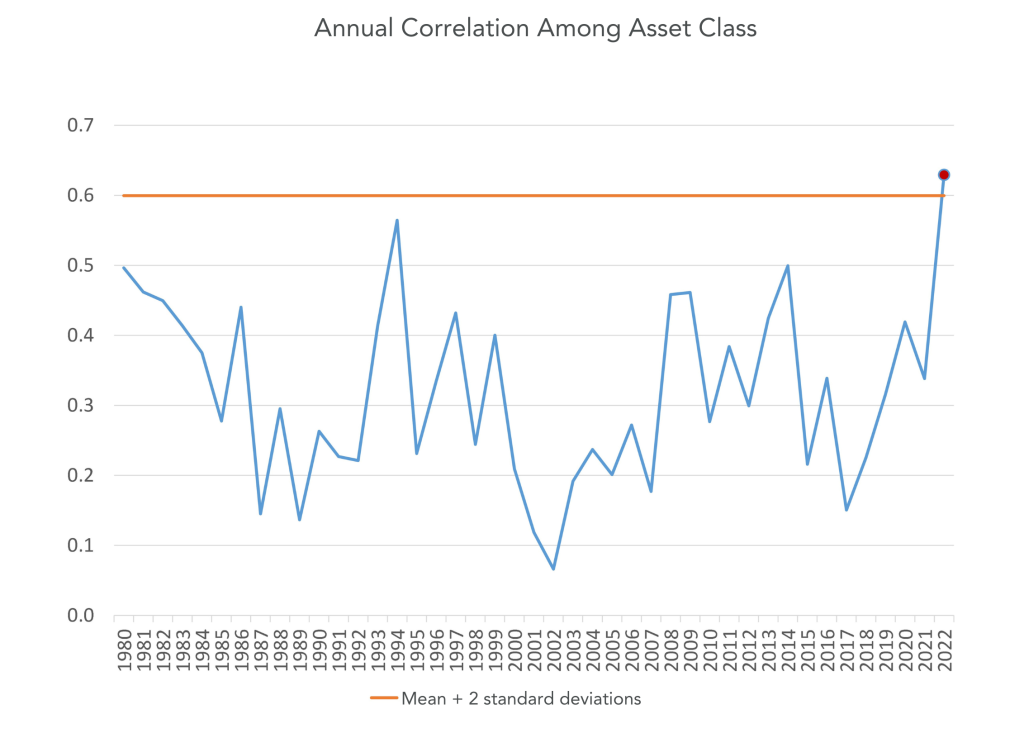

The only sector to post positive returns within the Russell 2000 Index was the energy sector, which benefitted from the war in Ukraine and several years of underinvestment following the commodity’s price collapse in 2014. Within Canada’s main S&P/TSX Composite, the energy sector also rose, while the consumer staples and industrial sectors eked out small gains. The other eight industry groups posted declines ranging from -0.2% to -62%. Assets correlations, in fact, were the highest seen in more than 40 years, as can be seen below.

Measures of both investor and consumer sentiment, including the well-known Michigan Consumer Survey, also reached extremely negative levels in 2022. In fact, in this environment, even prior market darlings, namely the FAANG stocks, offered no protection, with the five constituent stocks dropping an average of 46.1% (Meta/Facebook, Amazon, Apple, Netflix and Alphabet/Google). For several years, it seemed all investors had to do was to own these winning stocks, but even they were not immune from the forces of selling.

This market downdraught has pressured savings during a time of rising inflation, and fears of a pending recession are palpable. Cracks in the economy have started to appear, and rarely a day passes without news of more lay-offs at large companies. However, all this negativity also offers opportunity. Public markets are dynamic and have priced in a more difficult environment over the next one to two years. Within that context, there are some positives that can be salvaged from the dismal year that was.

The Good

Markets look forward, not backward. Certainly, the market’s view of the future is not always correct. As it stands now, the market is taking a dim view of the economic and interest rate outlook. Most fast-growing, highly valued companies have seen their share prices fall precipitously. Consumer discretionary and housing stocks have also been hurt as fears of a recession mount. Businesses that need outside equity or debt capital to finance their objectives have seen their stock prices hit especially hard.

Fortunately, the past indicates that such significant declines often offer patient, long-term oriented investors, an opportunity to buy strong franchises at a meaningful discount. Pembroke’s investment team carefully monitors its holdings at the company-specific level, but also at the portfolio level.

Currently, several important positives stand out:

- Valuation levels are attractive on a multi-year basis. While a recession is possible, the markets have already discounted a downturn. Could it be worse or longer than currently predicted? Yes. But it could also be better and shorter than some worry. Either way, the current valuations offer significant upside on a three to four-year basis.

- Balance sheets remains strong. During periods of market or economic stress, robust balance sheets allow companies to “weather the storm” without accessing dilutive capital. In the best-case scenario, well-managed businesses are able to put their balance sheets to work by investing in their competitive advantages, or by acquiring weaker peers.

- The era of “free money” is behind us. Historically low interest rates saw many businesses with unproven models attract huge valuations. Many investors chased hot themes and sectors without regard for valuations or business sustainability. In this environment, active managers focused on quality companies were not always rewarded for their discipline. Many broad-based indices, or certain stock groups (e.g. FAANG stocks), performed exceptionally well. The absence of free money should mean that picking well-financed companies focused on per share growth and earning a return on invested capital will be rewarded once again. Pembroke, certainly, hopes for this to be the case.

- History is on investors’ side. Just as markets overshoot on the upside when times are good, they often overshoot to the downside when fear overrides rational, long-term thinking. The desire for liquidity, or simply to “get out of the way”, presents an opportunity for those who can stay the course, or even put new capital to work.

So “the good” is that “we are where we are today”. Nothing can be done about 2022, but lessons have been learned, poor business models have been unmasked, and equity investors have already discounted a challenging interest rate and economic backdrop. The outlook from here, therefore, is compelling.

The Outlook

The team at Pembroke does not focus its efforts on macroeconomic predictions. There are too many factors and too many unknowns that affect how the future will unfold. Our contention is simply that over the long-term, technology, innovation and economies will move forward, not backward. In other words, history indicates that optimism pays.

Furthermore, when markets turn sour, they offer opportunity more often than not for investors who can look past the short term. The trick is to find the companies that have the products, services, business models and balance sheets to survive and prosper.

Our positive outlook, therefore, is based on our confidence in our holdings and their prospects. While growth is rarely linear, our belief is that many of our companies will deliver revenue and earnings much higher in three years than they did in 2022. While 2023 might be a difficult year for some businesses, if the executives and boards running these companies run their finances responsibly, shareholders should be rewarded over time. It is for that reason that we back shareholder-aligned management teams focused on long-term growth and per share progress.

Our team is scouring the landscape for new opportunities. Some exciting businesses that saw their share prices soar to unthinkable levels are now trading at reasonable levels once again. Many cyclical businesses, even those armed with good balance sheets, have seen their share prices collapse on near-term recession fears, despite compelling multi-year outlooks.

As a team, we expect to be active, but selective. We also recognize that market timing is futile: the market can turn lower or quickly move higher without warning. However, in the end, well-run companies with sound business models will create wealth for their shareholders. Riding out difficult market conditions is critical to investing success.

Other Articles Of Interest

Disclaimer

This report is for the purpose of providing some insight into Pembroke and the Pembroke funds. Past performance is not indicative of future returns. Any securities listed herein, are for informational purposes only and are not intended and should not be construed as investment advice nor is it a recommendation to buy or sell any particular security. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Pembroke seeks to ensure that the content of this document is correct and up to date but does not guarantee that the content is accurate and complete and does not assume any responsibility for this. Pembroke is not responsible for decisions or actions taken or made on the basis of information contained in this document.