January 2025

When it comes to building wealth, the concept of compounding is one of the most powerful tools at your disposal. Registered accounts such as RRSPs, TFSAs and FHSAs not only offer tax advantages, but also allow your investments to grow exponentially over time thanks to compounding.

But did you know that the timing of your contributions can significantly affect the outcome?

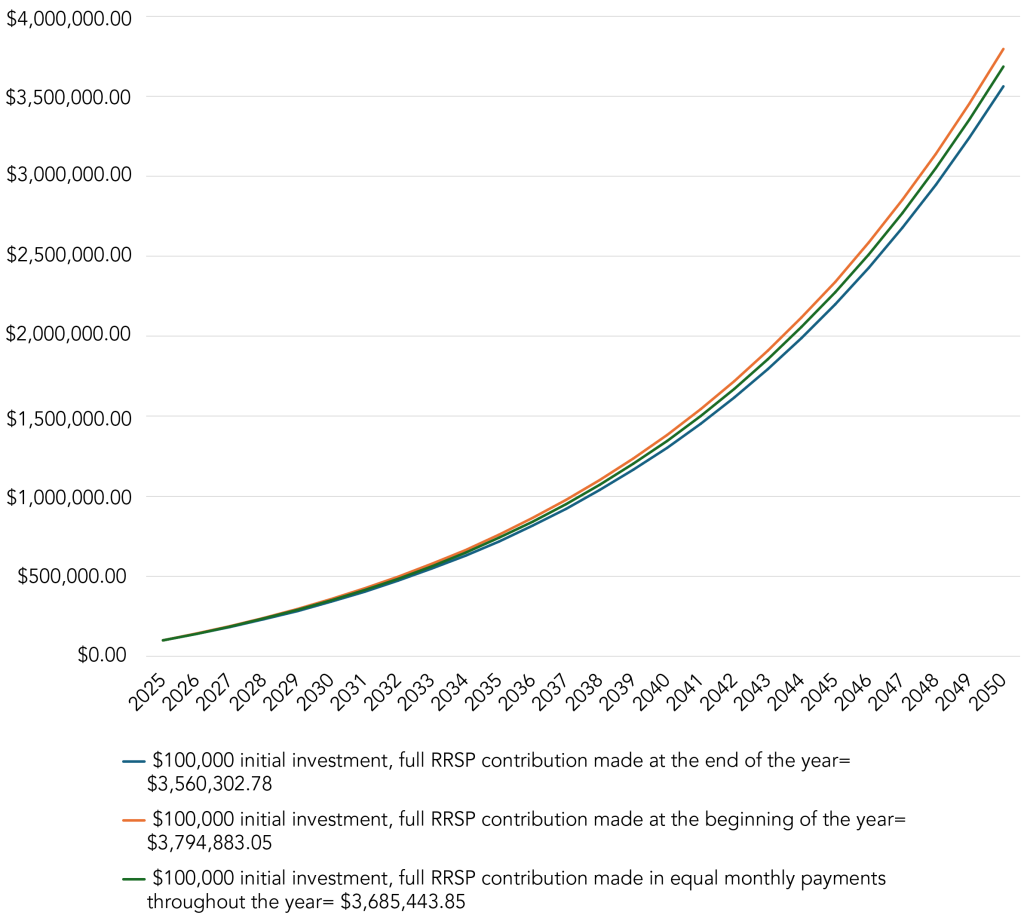

Take the example of an RRSP investment: starting with $100,000 and growing at 8% per year, the timing of your contributions—whether made at the beginning of the year, each month or at the end of the year—can make a significant difference over a 25-year period.

The Power of Early Contributions

Parameters of the graph: 8% compounding annually. Ignoring tax considerations as it is within a registered plan. Contributions are indexed at 2% increase per year to reflect a rise in the RRSP contribution limit over the lifetime of the individual’s investment horizon. Disclaimer: This chart is for illustrative purposes only. The assumed 8% annual compounded return is not guaranteed and does not represent actual investment performance. Results may vary due to market volatility. Past performance is not indicative of future returns.

Why Early Contributions Work

The principle is simple: compounding grows your wealth by earning returns not only on your initial investment, but also on the returns that accumulate over time. Registered accounts such as RRSPs shelter these returns from taxes, amplifying the effect.

In a high-growth scenario, even a small adjustment in timing—such as making contributions earlier in the year—can have a significant impact on your portfolio’s performance. In the example shown in the chart above, the difference over 25 years between a full contribution at the beginning of the year and a full contribution at the end of the year is $234,580.24.

By using registered accounts and the benefits of compounding, you can put your savings on the fast track to growth. For tailored advice, contact your Pembroke representative to develop a strategy that meets your financial goals and helps you maximize the benefits of compounding.

Registered Account Limits for 2024 and 2025

Tax-Free Savings Account (TFSA): $7,000 for 2025. Unused contribution room carries forward indefinitely, providing flexibility for larger contributions in the future.

Registered Retirement Savings Plan (RRSP): The contribution limit for 2025 is the lesser of 18% of your previous year’s earned income, or the government-set annual limit of $32,490. For 2024, the limit is $31,560. If you did not contribute up to your limit in previous years, you can carry over any unused contribution room. The deadline to contribute to your RRSP for 2024 is Monday, March 3, 2025.

First Home Savings Account (FHSA): $8,000 per year, with a lifetime limit of $40,000. Unused contributions can be carried forward.

Other Articles Of Interest

Disclaimer

This report is for the purpose of providing some insight into Pembroke and the Pembroke funds. Past performance is not indicative of future returns. Any securities listed herein, are for informational purposes only and are not intended and should not be construed as investment advice nor is it a recommendation to buy or sell any particular security. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Pembroke seeks to ensure that the content of this document is correct and up to date but does not guarantee that the content is accurate and complete and does not assume any responsibility for this. Pembroke is not responsible for decisions or actions taken or made on the basis of information contained in this document.