The World Meteorological Organization was established in 1950 as a specialized agency of the United Nations. It traces its origins to the International Meteorological Organization, established in 1879, which also traces its origins to the need to answer a simple question: “Am I sailing into a storm?”[i]

Industrialization and globally coordinated meteorology have a common liftoff point in the late 19th century, and it is for this reason that the 2015 Paris Accord identifies the objective of limiting global temperatures to 1.5 degrees Celsius above “pre-industrial” levels.[ii]

Climate scientists identify the pre-industrial period as the second half of the 19th century, when the combustion of fossil fuels began to drive transportation and industry, and standardized annual global climate measurements first became available.[iii]

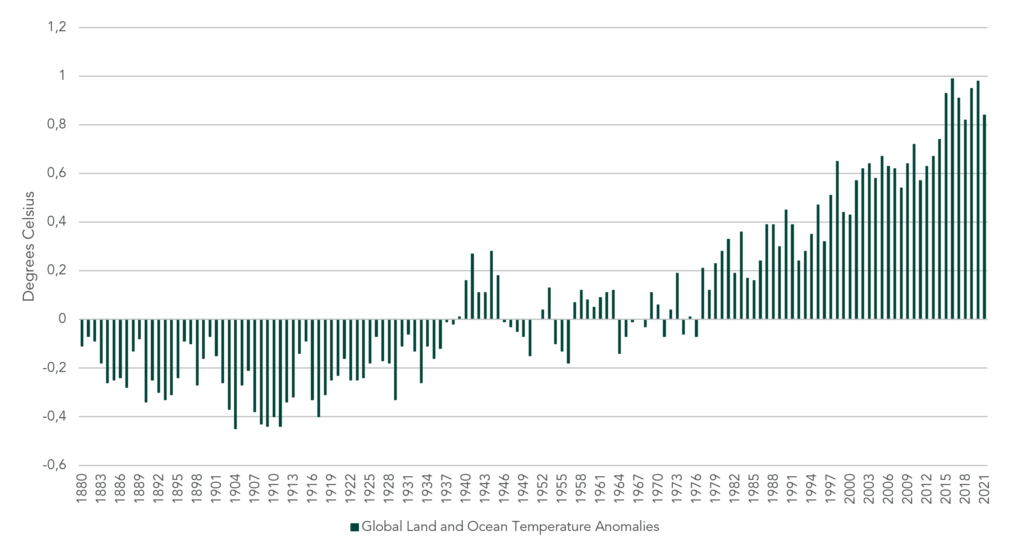

The link between human greenhouse gas (GHG) emissions and the warming planet is unequivocal.[iv] The planet has already warmed by approximately 1 degree Celsius since pre-industrial times.[v] The United States National Oceanic and Atmospheric Administration (NOAA) recently reported that 2021 was the 45th year in a row that global temperatures have exceeded the 20th-century average (Exhibit 1).

The economic losses associated with climate change due to fires and flooding continue to worsen. [vi] The Intergovernmental Panel on Climate Change (IPCC) estimates that on our present trajectory, we will reach 1.5 degrees Celsius of warming in just 18 years, by 2040. These facts about climate change are influencing Canadian government legislation and central bankers’ planning and are also being considered by prudent long-term oriented equity market investors.

Exhibit : Global Land and Ocean Temperature Anomalies

In June 2021, Canada passed into law the Canadian Net-Zero Emissions Accountability Act. This act commits Canada to a reduction in GHG emissions of 40% to 45% below 2005 levels by 2030, and net zero emissions by 2050, with a comprehensive review four years from now in 2026.[vii] The implied overhaul of Canada’s economy over the next three decades to meet these goals is unprecedented.

While the energy, utilities, and materials sectors account for the largest share of Canada’s GHG emissions, achieving net zero emissions will require major changes across all sectors. Pembroke believes that these changes, and the attendant risks and opportunities, are already being priced into Canadian equities.

On January 14, 2022, the Bank of Canada released a report using scenario analysis, as recommended by the Task Force on Climate-Related Financial Disclosures (TCFD) to assess climate change risks to Canada’s financial system.[viii]

Climate risk is routinely categorized as either physical risk (risk to structures and business operations from increased wildfires, storms, and rising sea levels), or transition risk (risk to earnings and assets from changing legislation and changing consumer preferences resulting from the transition to a net zero emission economy).

The Bank of Canada report highlights the exposure of different economic sectors of the Canadian economy under four different climate transition pathway scenarios from 2020 to 2050.

Pembroke has begun to explore its portfolio exposure to climate transition risk. Our assessment begins with an attempt to measure the C02 emissions of companies held in Pembroke-managed Canadian and US equity portfolios. This is achieved in several ways.

First, Pembroke has access to reported C02 emissions from companies that report this data. Second, Pembroke has access to third-party estimates of the C02 emissions of its portfolio holdings. Third, Pembroke polled its holdings in 2021, asking them if they had already disclosed their climate risks and opportunities and, if they had not, if they would commit to doing so in the next three years (2022–2024 period). Using this approach, Pembroke is building a “best estimate” of its portfolio’s level of C02 emissions exposure.

Armed with a portfolio C02 emissions estimates, Pembroke can undertake various studies to better understand total portfolio emissions, relative portfolio emissions (versus a benchmark or objective), the origin of portfolio emissions by sector and by company, and the most efficient way to reduce portfolio climate transition risk from exposure to C02 emissions.

Polling our portfolio companies and asking them if they will commit to releasing climate risk and opportunity information before 2025 is also an engagement. It signals that climate transition risk falls into our current investment forecast horizon. That is an important message and part of our stewardship responsibility as long-term growth investors.

[i] See https://public.wmo.int/en/about-us/who-we-are/history-of-wmo

[ii] See: https://unfccc.int/sites/default/files/english_paris_agreement.pdf and https://www.ipcc.ch/sr15/faq/faq-chapter-1/

[iii] https://www.ipcc.ch/sr15/faq/faq-chapter-1/

[iv] See: IPCC, 2021: Summary for Policymakers. In: Climate Change 2021: The Physical Science Basis. Contribution of

Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [MassonDelmotte, V., P. Zhai, A. Pirani, S.L. Connors, C. Péan, S. Berger, N. Caud, Y. Chen, L. Goldfarb, M.I. Gomis, M. Huang, K. Leitzell, E. Lonnoy, J.B.R. Matthews, T.K. Maycock, T. Waterfield, O. Yelekçi, R. Yu, and B. Zhou (eds.)].

Cambridge University Press. In Press.

[v] https://www.ipcc.ch/sr15/faq/faq-chapter-1/

[vi] https://www.munichre.com/en/risks/natural-disasters-losses-are-trending-upwards.html

READ THE FULL PERFORMANCE UPDATES:

- Pembroke’s Canadian Bond Fund

- Pembroke’s Corporate Bond Fund

- Pembroke’s Canadian Balanced (Growth and Income) Fund

- Pembroke’s Global Balanced Fund

Or see the current overview for all of Our Solutions

Other Articles Of Interest

Disclaimer

This report is for the purpose of providing some insight into Pembroke and the Pembroke funds. Past performance is not indicative of future returns. Any securities listed herein, are for informational purposes only and are not intended and should not be construed as investment advice nor is it a recommendation to buy or sell any particular security. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Pembroke seeks to ensure that the content of this document is correct and up to date but does not guarantee that the content is accurate and complete and does not assume any responsibility for this. Pembroke is not responsible for decisions or actions taken or made on the basis of information contained in this document.