EXECUTIVE SUMMARY

- In this paper, we address the pace of change in the investment management industry and describe the innovations that Pembroke has been making to ensure that we continue to deliver value to our clients.

- Responding to client demand, Pembroke added two new strategies in 2018 and 2019, the Pembroke Concentrated Fund and The GBC Global Balanced Fund. Pembroke now offers nine strategies giving clients the ability to diversify across assets, geographies and styles. Our new strategies share an important common feature: they use existing resources and capabilities to offer our clients more without diluting our focus.

- To build a better understanding of our private investors’ requirements, Pembroke continues to develop new tools and discussion frameworks. These frameworks help clients to articulate asset allocation objectives and help Pembroke representatives to recommend investment strategies that are suitable solutions.

- Pembroke has always been committed to strong governance and responsible investing. Recently, we became a signatory to the United Nations Principles for Responsible Investing (UNPRI). Within the UNPRI framework, we have more access to global ESG reporting and benchmarking information and increased avenues for collaboration.

- Pembroke is innovating to improve our client experience. We recently developed a new website and client portal, new customized monthly performance reports for our representatives, and eSign document capabilities that allow our clients to conduct business remotely in a secure environment. Our new fee models, including the Pembroke Family Advantage Program, result in enhanced fee transparency, more aligned fee structures and, in certain cases, reduced fees.

- The virtuous circle of innovation is spinning in ever tighter, ever faster loops. This is why listening to our clients is so important. Our clients have more choice than ever before, and more insight to offer us about what is valuable to them. After more than 50 years of successful investing for our clients, we know that in innovation, there is no such thing as finished business.

No such thing as finished business

In what might appear an unnecessary redundancy, projects are increasingly asked for: “done and finished”. The double emphasis on full and timely completion is, nonetheless, imperative when cross-departmental teams are collaborating with shared resources on overlapping projects, and missed timing means time lost. This is the exhilarating urgency that innovation creates whether you are in Montreal or Mumbai, whether you are in merchandising or fund management. There is a shortening of timelines, a quickening of the pace at which new products and services shape client experience and raise client expectations. It is the virtuous circle of innovation, spinning in ever tighter, ever faster loops.

This is why listening to our clients is so important. Our clients have more choice than ever before, and more insight to offer us about what is possible. What have they told us? They have told us that while they value the focus we maintain, they want more diversified investment solutions from us. They want the ability to further diversify their investments by geography, size, and risk. They want advice about how to diversify and they want to know more about what they own. While they want their investments to earn a healthy return, they want to know that the companies they invest in will contribute to a healthier planet. While they value our personal service, they want access to all their information, all the time, from any device. While they value their relationship with us, they want the benefits of those relationship to extend deeper into current and future generations.

Our clients remind us of what we have always known, that the end of each completed project marks the beginning of a new one and that, where innovation is concerned, there is no such thing as finished business.

Maintaining our focus while offering more

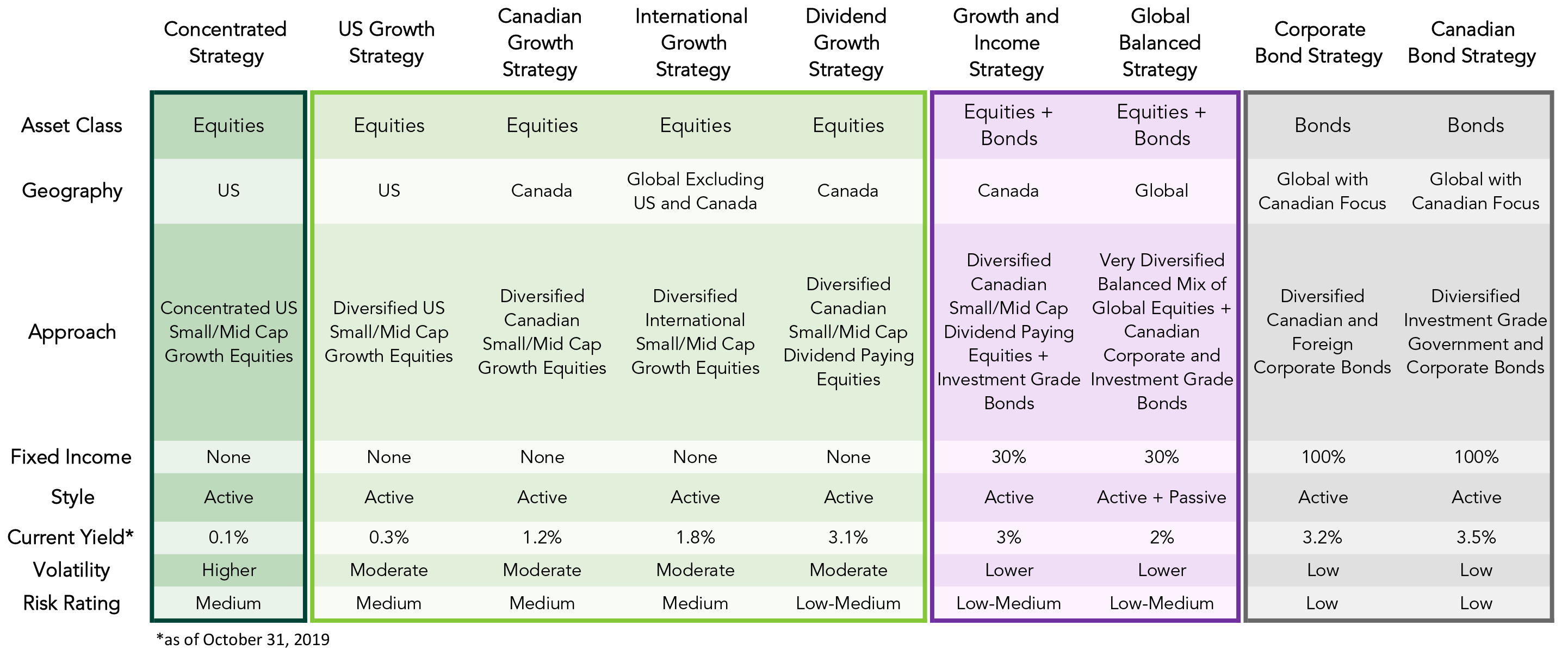

Since 1968, Pembroke has specialised in investing in small to mid capitalization, high-quality, growth companies. This focus has built a following for Pembroke of institutional and private clients who have come to us for our Canadian and US small to mid-cap growth strategies. Beginning in 1988, Pembroke Private Wealth Management began to offer additional strategies to our private clients. These included externally managed Canadian bond and international small cap growth equity strategies, as well as a balanced fund combining our Canadian bond and Canadian small-cap growth equity dividend strategies. This service offering combines three investment capabilities: investment management of in-house strategies, external manager selection, and asset allocation and rebalancing. Responding to client demand, Pembroke added two additional strategies in 2018 and 2019: the Pembroke Concentrated Fund and The GBC Global Balanced Fund. Pembroke now offers nine strategies giving clients the ability to diversify across assets, geographies and styles. These offerings are presented in Exhibit 1.

Exhibit 1: Pembroke Investment Strategies

The strategies in Exhibit 1 are presented from left to right showing Pembroke’s equity strategies, balanced fund strategies, and bond strategies. The first equity strategy shown is our latest and most concentrated strategy, the Pembroke Concentrated Fund. This strategy, for institutional and accredited investors, holds between 12-18 positions with average weights of 6-8%. The positions are selected from our existing US and Canadian portfolios and thus come directly from Pembroke’s research platform. The fund is managed with a long-term outlook, holding high-conviction positions for multi-year holding periods.

Another recent offering, The GBC Global Balanced Fund, is shown in the seventh column in Exhibit 1. This strategy, a diversified global investment vehicle, draws directly from Pembroke’s research platform but also from our sub advisors and from other externally managed active and passive funds. It also draws on Pembroke’s asset allocation and rebalancing skills. The fund’s asset allocation target is 70% global equities and 30% Canadian fixed income with 80% active and 20% passive exposure. By creating rebalancing corridors for each asset class, we maintain the fund’s strategic asset allocation, increasing exposure to underperforming asset classes while reducing exposure to outperforming asset classes.

The Pembroke Concentrated Fund and the GBC Global Balanced Fund are two new strategies that share an important common feature: they do not distract Pembroke’s investment team from its core job of managing its small to mid-cap, high-quality growth portfolios. Instead, we are using existing strategies and capabilities to offer our clients more choice.

Turning strategies into solutions

The investment industry loves to talk about solutions. Solutions, however, only exist in the context of problems or needs. Strategies don’t become solutions until they are matched with needs. To build a better understanding of our private investors’ requirements, Pembroke representatives work directly with clients, listening and working together to determine which Pembroke investment strategies may be best for them. When clients can confidently determine a suitable asset allocation, based on their investment knowledge and time horizon, their investment objectives, and their risk capacity, we are able to recommend Pembroke investment strategies that become solutions, fixed in an appropriate risk and return framework (Exhibit2).

Exhibit 2: A Range of Pembroke Solutions

Healthier investments

Pembroke has always been committed to strong governance and responsible investing and has taken steps over the years to formalize that commitment. We published our proxy voting guidelines in July 2005 relating our fiduciary obligation to exercise our voting rights with our ability to enhance shareholder value on a long-term basis. In September 2016, we published our responsible investment policy asserting our belief that sound environmental, social and governance (ESG) practices can reduce a firm’s risk and improve its operational, financial, and stock price performance.

We added to our company analysis a proprietary ESG scoring system which prompts our analysts and portfolio managers to ask questions of the companies in which we invest. When capital providers like Pembroke engage with companies and let them know the ESG issues that may be decision criteria for us, companies are prompted to take the same issues into consideration when they allocate capital. We have also created regular ESG reporting templates for clients and consultants in Canada, the US, and Europe to share our progress. Finally, we engage with our community – participating in ESG conference panels and other forums to gather information and share best practices. In 2019, after discussions with our clients and with the United Nations Principles for Responsible Investing (UNPRI), we became a signatory to the UNPRI.

Our commitment to the UNPRI’s principles is consistent with our values of integrity, accountability and alignment. Our decision to join the UNPRI has several benefits for Pembroke and for our clients. First, it brings us into a more formal framework for monitoring ESG metrics. Within the UNPRI framework, we will have more access to global reporting and benchmarking information and increased avenues for collaboration. As more investment managers report their environmental, social and governance activities in the UNPRI’s common framework, transparency should increase and help investors to make more informed decisions.

Delivering a better experience

While a significant part of the innovation effort at Pembroke is in manufacturing sustainable long-term growth strategies and solutions for our clients, the effort falls short if our clients don’t have an excellent experience. Client experience includes every contact between Pembroke and our clients, from face to face meetings with our representatives and managers, to our website and client portal, to our newsletters and performance reports, to our billing and tax reporting. Over the past two years, we have made significant efforts in these areas in response to client suggestions.

At the end of 2018, we launched a new website to provide better access to our information, an enhanced experience for tablet and mobile phone users, and new areas for content and insights. We added a new client portal that gives detailed performance, asset allocation, and transaction reporting at both the household and individual account level. A documents section provides statements and tax reports. A resources tab provides access to fund facts and prospectus documents. Along with new customized monthly performance reports for our representatives and eSign document capabilities for annual know-your client (KYC) forms and other documents, we are making it easier for Pembroke clients and employees to exchange information and conduct business remotely in a secure environment.

We also reviewed our fee model and made two changes to benefit our clients. First the management fee model in the GBC mutual funds was adjusted so that fees are paid by unitholders through the redemption of units rather than within the funds. This approach results in enhanced fee transparency, aligns the mutual fund fee structure with the pooled fund fee structure, and, in certain cases, results in reduced fees. We also launched the Pembroke Family Advantage Program enabling Pembroke’s private clients to extend many of the Pembroke benefits they enjoy to virtually all members of their family. Benefits include using the combined value of family holdings to determine management fees.

The Pembroke Family Advantage Program uses a broad definition of “family” which allows daughters and sons, nephews and nieces, brothers and sisters, life partners, grandparents and other family members to benefit from their combined account size regardless of their age or address. This innovative approach exceeds industry standards and is already benefiting many of our clients. Family-based pricing allows us to offer lower fees to more clients while also deepening the relationship with our client’s families and offering more.

Conclusion

The changes in the Canadian investment management industry in recent years are momentous and affect our clients’ choices as much as our own. These shifts create challenges and opportunities for incumbent firms like Pembroke and create benefits for clients, including greater choice and lower costs. The trick, as ever, is to protect what we do well and simultaneously drive forward in those areas where we can create more value for clients. It is a constant cycle of growth-feedback-innovate-growth.

Responding to our clients’ feedback, we have introduced new strategies and tools to understand our clients better and to turn strategies into solutions. We have maintained our focus on sustainability but with increased diligence, transparency, and accountability. We have enhanced our digital presence so that our clients can engage with us on their terms and adjusted our fee model to be more flexible and invite a broader relationship. As we strive each day to deliver projects “done and finished”, we recognize as well that the innovator’s business is, by definition, never finished.

This report is for the purpose of providing some insight into Pembroke and the GBC funds. Past performance is not indicative of future returns. Any securities listed herein, are for informational purposes only and are not intended and should not be construed as investment advice nor is it a recommendation to buy or sell any particular security. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Pembroke seeks to ensure that the content of this document is correct and up to date but does not guarantee that the content is accurate and complete and does not assume any responsibility for this. Pembroke is not responsible for decisions or actions taken or made on the basis of information contained in this document.

Publish Date: November 28, 2019