April 2024

Pembroke’s U.S. Growth Strategy continued to rise after a surge in the last two months of 2023. The portfolio outperformed its primary benchmark, the Russell 2000 Index. Both stock selection and sector allocation contributed to the positive absolute and relative results. In particular, strength in the Industrials, Technology and Consumer Discretionary sectors drove performance in the first three months of 2024. While less profitable, lower-quality stocks led the market’s advance in late 2023, which is typical of the early stages of a significant rally, quality was rewarded by investors at the start of the new year.

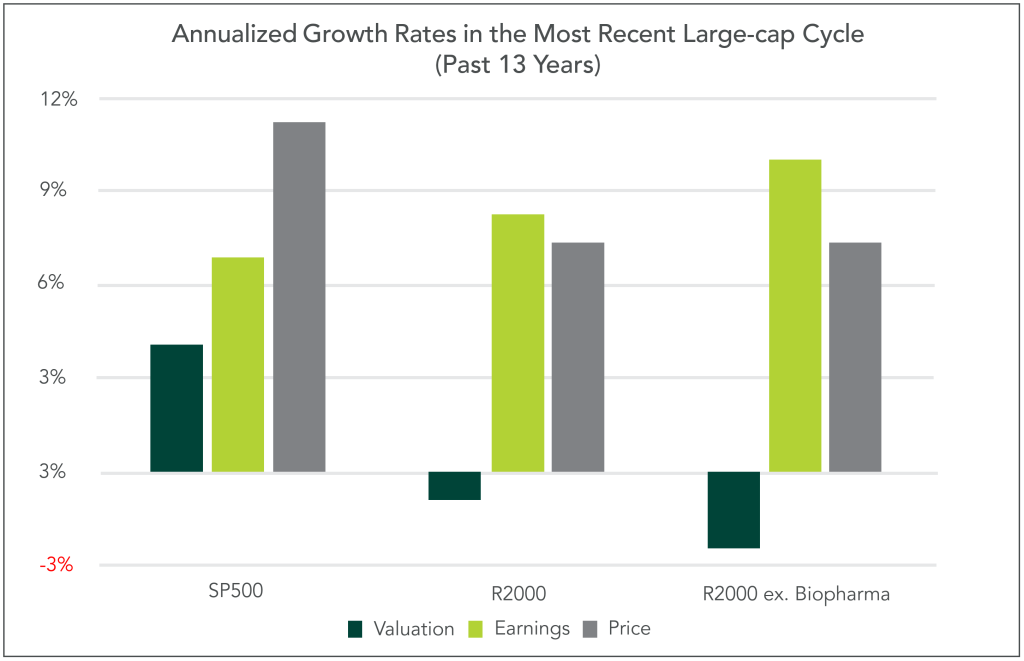

While the S&P 500 has also rallied, driven in part by the 82.5% rise in Nvidia (NVDA), small- and mid-cap stocks are playing their part in this new bull market. It has been a frustrating decade for the asset class as investors flocked to mega-cap technology companies. The discrepancy between fundamentals and valuations makes a compelling case for investors to turn their attention back to less followed companies. In fact, contrary to popular belief, earnings growth for companies in the Russell 2000 has outpaced that of the S&P 500 constituents over the past 13 years. However, this growth has not been matched by a similar expansion in valuations.

From a company-specific perspective, shares in Pure Storage (“PSTG”), an innovative technology company disrupting the storage industry, soared after the company reported strong results and guidance. Management is building the company’s impressive recurring revenue base and generating significant free cash flow, while investing in its ongoing research and development efforts. The company is seeing increasing demand as a result of robust investment in artificial intelligence (AI).

Meanwhile, companies with business models that face potential disruption from AI are being aggressively sold by investors. While the pace and direction of this powerful new technology remain unclear, investors are generally choosing to avoid the uncertainty. Shares in WNS Holdings (“WNS”), which outsources back-office processes to low-cost regions such as India, have fallen on fears that AI will replace the need for human involvement.

Pembroke maintains its position in WNS because of the company’s history of integrating new technologies into its service offering to drive efficiencies and improve customer engagement. In fact, WNS has been an early adopter of technologies, such as predictive analytics and robotic process automation. The company is already being asked by customers to incorporate AI into its offerings. WNS has been buying back shares aggressively during the current share price downturn. Nevertheless, Pembroke is keeping a close eye on any developments that could shake its confidence in WNS’s long-term prospects.

Other Articles Of Interest

Disclaimer

This report is for the purpose of providing some insight into Pembroke and the Pembroke funds. Past performance is not indicative of future returns. Any securities listed herein, are for informational purposes only and are not intended and should not be construed as investment advice nor is it a recommendation to buy or sell any particular security. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Pembroke seeks to ensure that the content of this document is correct and up to date but does not guarantee that the content is accurate and complete and does not assume any responsibility for this. Pembroke is not responsible for decisions or actions taken or made on the basis of information contained in this document.