June 2024

In today’s financial landscape, understanding market volatility is critical for all investors. In the post-pandemic era of heightened market volatility, it is more important than ever to understand the nuances of volatility and its impact on investment portfolios.

Volatility, often used in conjunction with standard deviation, measures how much a stock’s price varies over time. Higher volatility suggests greater price swings, highlighting the uncertainty surrounding the future price of an asset. However, volatility does not inherently imply risk, but rather reflects price fluctuations.

Impact on Investors and Their Portfolios

Market volatility has a significant impact on investment portfolios. High volatility can lead to emotional decision-making, where investors buy at market highs out of fear of missing out (FOMO) and sell at market lows out of panic. Such actions can erode returns, underscoring the importance of adhering to a strategic investment plan. Volatility tests the emotional resilience of investors. Emotional biases, such as fear and greed, often lead to impulsive decisions that deviate from well-thought-out strategies.

The example of Peter Lynch’s Magellan Fund illustrates this point. Peter Lynch, renowned as one of the world’s greatest investors, ran the Fidelity Magellan Fund from 1977 to 1990. The fund achieved an extraordinary average annual return of 29.2%, significantly outperforming the S&P 500 over the same period. However, despite these impressive returns, many investors lost money due to poor timing, buying high and selling low.

This paradox highlights the critical role of investor behaviour in determining investment outcomes.

Staying Invested During Volatile Periods

History shows that staying invested during volatile periods often produces better long-term results than trying to time the market. For example, missing just the ten best trading days over a decade can drastically reduce returns. This highlights the need for patience and a long-term perspective when investing.

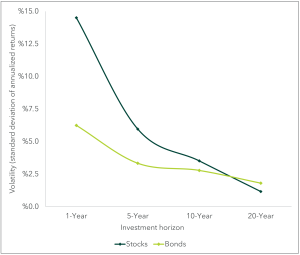

“It is time in the market that matters, not timing the market,” as Ian Soutar, one of the founders of Pembroke, often emphasized, echoing the sentiment originally articulated by Kenneth Fisher. Indeed, a longer investment horizon generally leads to better returns and lower volatility.

For example, bonds, with their predictable interest and principal payments, have lower volatility over shorter time horizons than equities. But for long-term investors, the past has shown that equities tend to be less volatile in the long run.

However, it is important to note that as the need to withdraw funds approaches, reducing portfolio volatility becomes critical, often by adding fixed income to the investment mix.

The Efficient Frontier and Risk Management

The efficient frontier concept helps investors understand the trade-off between risk and return. It highlights the fact that higher returns typically come with more risk, and that there are no investments that offer high returns without risk. Balancing risk and potential return is essential to optimizing investment strategies.

Volatility can reflect perceived risk rather than actual risk. For instance, private equity investments, which are often viewed as lower risk because of their less frequent valuations, may have higher actual risk because of a significant leverage used to enhance returns. Understanding this distinction is essential to making informed investment decisions.

Pembroke’s Approach to Volatility

Pembroke emphasizes a disciplined approach to managing volatility by focusing on long-term fundamentals and maintaining a diversified portfolio. Strategies for mitigating risk while seeking growth include the following.

- Focus on quality: investing in companies with stable earnings and consistent cash flows to enhance portfolio stability.

- Avoid highly leveraged companies: prefer companies that do not rely heavily on the capital markets, thereby reducing equity volatility.

- Diversification: spread investments across different sectors and business models to minimize risk concentration.

- Leverage liquidity: using periods of market volatility to buy undervalued stocks.

- Management alignment: favouring companies with significant insider ownership, aligning management interests with shareholders.

Understanding and managing market volatility is essential to successful investing. By recognizing the nature of volatility, staying invested and maintaining a disciplined approach, investors can mitigate risk and achieve their long-term financial goals.

Pembroke’s commitment to providing insightful advice and robust strategies ensures that our clients are well equipped to navigate the complexities of volatile markets. In the end, understanding market volatility and employing effective strategies can significantly improve investment outcomes.

Other Articles Of Interest

Disclaimer

This report is for the purpose of providing some insight into Pembroke and the Pembroke funds. Past performance is not indicative of future returns. Any securities listed herein, are for informational purposes only and are not intended and should not be construed as investment advice nor is it a recommendation to buy or sell any particular security. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Pembroke seeks to ensure that the content of this document is correct and up to date but does not guarantee that the content is accurate and complete and does not assume any responsibility for this. Pembroke is not responsible for decisions or actions taken or made on the basis of information contained in this document.