A central theme of the just concluded COP 27 (the 27th Conference of the Parties of the United Nations Framework Convention on Climate Change) in Sharm El-Sheikh is the transition now underway from commitments to action. While countries are the parties bound by their commitments under the Paris Agreement, they must catalyze non-state actors, including corporations and financial institutions, in order to achieve their goals.

Private sector first movers in many countries have started to prioritize climate action and align their business plans with the Paris Agreement’s objective of limiting global warming to well below 2 C⁰ above preindustrial levels, and to make efforts to limit warming to 1.5 C⁰. They are announcing Net Zero greenhouse gas (GHG) emissions targets and aligning their strategies and investment plans with the Science-Based Targets initiative (SBTi).[1]

Countries and their institutions, however, are not all moving at the same pace. With each country’s progress at meeting its NDCs (Nationally Determined Contributions) to be disclosed in the global stocktake at COP 28 next October, pressure is already being exerted on businesses and financial institutions who will need to accelerate action if national goals are to be met.

Before COP 27, UN Secretary General António Guterres convened an 18-member High-Level Expert Group to address the emissions pledges of non-state actors[2]. The Expert Group was chaired by former Canadian Minister of Environment and Climate Change Catherine McKenna. The Group’s report, Integrity Matters: Net Zero Commitments by Businesses, Financial Institutions, Cities and Regions, was highlighted at COP 27.

Mind the Disclosure Details

Remarking on the report on November 8th, the UN Secretary General reiterated the need for voluntary Net Zero pledges to be coherent with IPCC scenarios limiting warming to 1.5 C⁰: namely, reducing emissions by 45% by 2030 and reaching net zero by 2050.[3]

Among the requirements for entities presenting net zero emissions pledges, he noted the need to make these pledges publicly available, to include interim targets every five years starting in 2025, for companies to disclose all greenhouse gas (GHG) emissions and for financial institutions to disclose all financed activities.[4]

Ambitious Net Zero pledges by leading first-mover institutions, the coming global stocktake which is expected to show insufficient progress by many countries, and proposals from both the US Securities and Exchange Commission (SEC) and the Canadian Securities Administrators (CSA) for mandatory climate-related disclosures, suggest we may be nearing a tipping point. Slower-moving companies and financial institutions that do not disclose their emissions, make net zero emissions pledges and detail interim targets may find themselves increasingly disadvantaged in the transition to a low-carbon economy.

Financial institutions are the force multiplier in the system. Their climate disclosure requirements drive the behaviour of the companies they finance and insure. Financial institutions can report the emissions disclosed by the companies they finance or, when such reported emissions do not exist, can use estimates provided by third-party data providers.

It is in the clear interest of all stakeholders to have standardized, verified reported emissions, not estimates. With a possible tipping point approaching, how many companies are currently reporting CO2 and other greenhouse gas (GHG) emissions, let alone setting science-based net zero targets?

Start with the Data

Pembroke reviewed data from four equity indices that hold a total of more than 1,650 mostly larger companies with a combined market capitalization of nearly USD 60 trillion across 23 developed markets:

- The S&P/TSX Composite Index (237 companies listed in Canada)

- The S&P 500 INDEX (approximately 500 companies listed in the United States)

- The STOXX Europe 600 Price Index (600 companies listed on exchanges in Europe)

- The Bloomberg APAC Developed Markets Large & Mid Cap Price Return Index (312 companies listed on exchanges in the Asia Pacific region).

Companies in each of these four indices were grouped into market capitalization tiers: top tier, mid tier, and bottom tier of market capitalization and, using data provided by Bloomberg, sorted by the category of their emissions: “Reported” or “Estimated”.

At the individual company level, categorization may be complicated by reporting dates, reporting practices, or other factors. At the index level, however, broader inferences about reporting rates may be drawn. Our hypothesis was that a larger proportion of companies in the top tier of market capitalization would report emissions than those in the bottom tier. The results of the analysis, however, were not uniform.

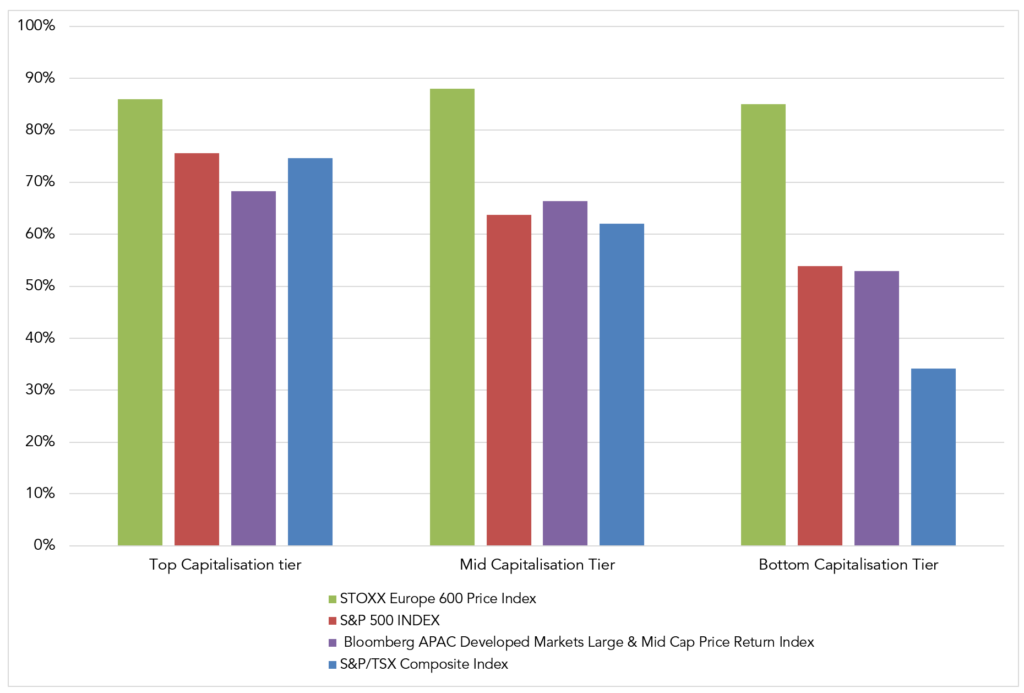

Exhibit 1: Percent of Index Companies Reporting CO2 Emissions

More than 85% of companies in each capitalization tier of the STOXX Europe 600 Index appear to report emissions. In no tier of the Canadian, US, or Asia-Pacific indices did average reporting approach 85%. In the mid-tier capitalization bucket, companies in the Canadian, US, and Asia-Pacific indices reported emissions at average rates between 60% and 70%. In the lowest capitalization tier, companies listed on the US and Asia-Pacific indices reported emissions in a little over half of cases. Canadian companies in the smallest tier are the outliers with only about a third of companies appearing to report emissions.

Who Reports and Why?

One hypothesis for the low rate of disclosures in the bottom size tier of Canadian-listed companies on the S&P/TSX Composite Index is that they are smaller, on average, than the companies in the bottom size tier of the other three indices and may lack the resources to report emissions data.

The average market capitalization of companies in the bottom tier of the S&P/TSX Composite Index in our November 2022 study was just over USD 1 billion. The average size of companies in the bottom tier of the selected European, Asian, and US indices was approximately USD 4 billion, USD 6 billion, and USD 13 billion respectively. So indeed, the average size of companies in the bottom tier of the Canadian index is smaller.

The high proportion of reporting European companies in the smallest market capitalization tier, however, belies the idea that smaller companies do not have the resources to gather, analyze, and report their emissions. According to Bloomberg data, the reporting rate among the smallest 5% (30 companies) of the STOXX 600 Index appears to be around 80%.

The smallest company by market capitalization in the index, the Swedish media and entertainment company Viaplay, with a market capitalization at the time of our report of USD 1.3 billion, produced an integrated 2021 Annual and Sustainability Report[5] with Scope 1, 2, and 3 emissions reported and with the baseline set according to Science-Based Targets initiative (SBTi) requirements. Both financial and non-financial targets are presented in the report including reducing GHG emissions by 46.2% by end of 2030. Supporting these targets is an interim five-year (2022–2026) sustainability strategy aligned with UN Sustainable Development Goals.

The forgoing discussion and example from the STOXX 600 Index of European companies suggest that, more than size, the factors that determine the consistency of corporate emissions reporting have to do with evolving national and supranational regulations, like the EU Corporate Sustainability Reporting Directive (CSRD), which is expected to widen the band of European companies captured by mandatory non-financial reporting requirements. In this general context, the gap in Exhibit 1 between European company emission disclosure rates and the rates in other countries may soon close.

As global sustainability accounting disclosures become mandatory in more regions and apply to more companies, they are also becoming more harmonized. Under the International Financial Reporting Standards (IFRS) Foundation, the International Sustainability Standards Board (ISSB) is working closely with the European Financial Reporting Advisory Group (EFRAG) to ensure alignment and interoperability.[6]

As an example of this alignment, beginning in 2024, the Carbon Disclosure Project (CDP), the global climate disclosure platform used by over 18,000 companies around the world, will incorporate the ISSB’s climate standard in their questionnaires.[7]

Leaning into Tipping

Our study suggests that publicly listed Canadian companies have significant progress to make if they are to catch up with global best practice and the expected tightening disclosure mandates. The opportunity for Canadian companies is that Canada is increasingly becoming a centre of activism, influence and innovation in the sustainability ecosystem.

The United Nations Biodiversity Conference (COP15) is being held in Montreal from December 7 to December 19, 2022. Earlier this year, the ISSB chose Montreal as the headquarters for its operations in the Americas and, in February 2023, Montreal will host the inaugural IFRS Sustainability Symposium.

With the radiating influence and activity of the ISSB hub in Montreal, the strong support of CPA Canada, and a fast-growing industry of sustainability consultants, Canadian companies have powerful resources to become leaders in sustainability and to meet or exceed the coming reporting requirements. Canadian financial institutions should also benefit from this growing hub of knowledge and expertise.

In this information-rich atmosphere, Pembroke is finding new opportunities to collaborate and learn. More than ever, nonfinancial factors including climate risks and opportunities and environmental, social, and governance (ESG) performance can be as important as financial factors in the appraisal of potential investments.

As a signatory to the UN-sponsored Principles for Responsible Investment (PRI) and a public supporter of the Task Force on Climate-Related Financial Disclosures (TCFD), we continue to engage with the companies we invest in. Furthermore, we are for the second year in a row writing to all investee companies encouraging them to report their climate risks and opportunities in line with TCFD recommendations.

[1] The SBTi reports that over 4,000 businesses and financial institutions are working with the initiative: https://sciencebasedtargets.org/companies-taking-action#table

[2] High-Level Expert Group on the Net-Zero Emissions Commitments of Non-State Entities

[3] The IPCC is the Intergovernmental Panel on Climate Change, an intergovernmental body of the United Nations tasked with providing scientific assessments on climate change to policy-makers.

[4] https://www.un.org/sg/en/content/sg/speeches/2022-11-08/secretary-generals-remarks-launch-of-report-of-high-level-expert-group-net-zero-commitments%C2%A0

[5] https://reports.nentgroup.com/media/w1jai3yx/nent_group_2021_annual_and_sustainability_report.pdf#

[6] https://www.ifrs.org/news-and-events/news/2022/11/issb-cop27-progress-implementation-climate-related-disclosure-standards-in-2023/

[7] https://www.cdp.net/en/articles/companies/what-does-cdps-incorporation-of-the-issb-climate-disclosure-standard-mean-for-european-companies

Other Articles Of Interest

Disclaimer

This report is for the purpose of providing some insight into Pembroke and the Pembroke funds. Past performance is not indicative of future returns. Any securities listed herein, are for informational purposes only and are not intended and should not be construed as investment advice nor is it a recommendation to buy or sell any particular security. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Pembroke seeks to ensure that the content of this document is correct and up to date but does not guarantee that the content is accurate and complete and does not assume any responsibility for this. Pembroke is not responsible for decisions or actions taken or made on the basis of information contained in this document.