December 2023

Pembroke is a signatory to the Principles for Responsible Investment (PRI). This requires us to submit regular reports on the progress we are making in the application of six core principles.

- Principle 1: We will incorporate ESG issues into investment analysis and decision-making processes.

- Principle 2: We will be active owners and incorporate ESG issues into our ownership policies and practices.

- Principle 3: We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- Principle 4: We will promote acceptance and implementation of the Principles within the investment industry.

- Principle 5: We will work together to enhance our effectiveness in implementing the Principles.

- Principle 6: We will each report on our activities and progress towards implementing the Principles

Source: PRI website

We have recently submitted our report and, in line with the sixth principle, we are pleased to share some of its contents with you.

Pembroke is committed to being a good corporate citizen and to limiting the environmental impact of our operations. We have now collected travel data for three calendar years and have raised the collective awareness of our own carbon footprint. We are also putting the finishing touches to an internal survey to understand the commuting habits of our employees. Once we have the data, we will be able to look at ways to positively influence behaviour to reduce our carbon footprint.

In recent years, Pembroke has introduced a Stewardship Policy to detail how the firm uses its influence to drive long-term sustainable value creation. We have also introduced a Diversity and Inclusion Policy to encourage the inclusion of different perspectives and ideas, mitigate groupthink, and ensure that the firm benefits from a more diverse and larger talent pool.

Our efforts to invest our clients’ capital responsibly focus on integration and engagement. The former refers to the integration of environmental, social and governance (ESG) risks into our investment analysis. We also engage with the management and/or board of portfolio companies where there are specific ESG concerns or where we are unable to obtain sufficient information. This engagement allows us to advocate for change and/or better disclosure.

Engagement

Aritizia (ATZ) has often been held up as an example of good corporate citizenship for its approach to sourcing raw materials from ethical sources. In the third quarter, we engaged with the company when allegations of a toxic work environment surfaced in the press. Our analysis is ongoing and we continue to monitor the situation.

We have also engaged with the management of Metro (MRU) regarding allegations by the Federal Government of price fixing in the grocery industry. Based on our discussions with management, we do not currently believe that the company is acting to the detriment of customers or other stakeholders. However, the government’s intervention in the industry has created a degree of uncertainty that could have a negative impact on the company’s growth plans.

The share price of WNS Holdings (WNS) has been under pressure on concerns that the company will be negatively affected by artificial intelligence (AI). Over the ten years that Pembroke has been a shareholder, we have been impressed by the company’s ability to weather currency devaluations and technological change. After extensive due diligence, Pembroke’s investment team concluded that WNS could be a beneficiary of AI rather than being harmed by it. Given the company’s healthy balance sheet and robust free cash flow profile, Pembroke engaged with the CEO and CFO in August to encourage a more aggressive share buyback. The company has since announced plans to buy back a further 7% of its shares.

Carbon Footprint

Pembroke’s growth investment style means that we are often investing in companies that are looking to change or disrupt the status quo. These modern technologies may help provide substitutes to polluting products, improve outcomes or cut costs in healthcare, enhance company efficiency, or reduce the use of scarce water or dirty fuels.

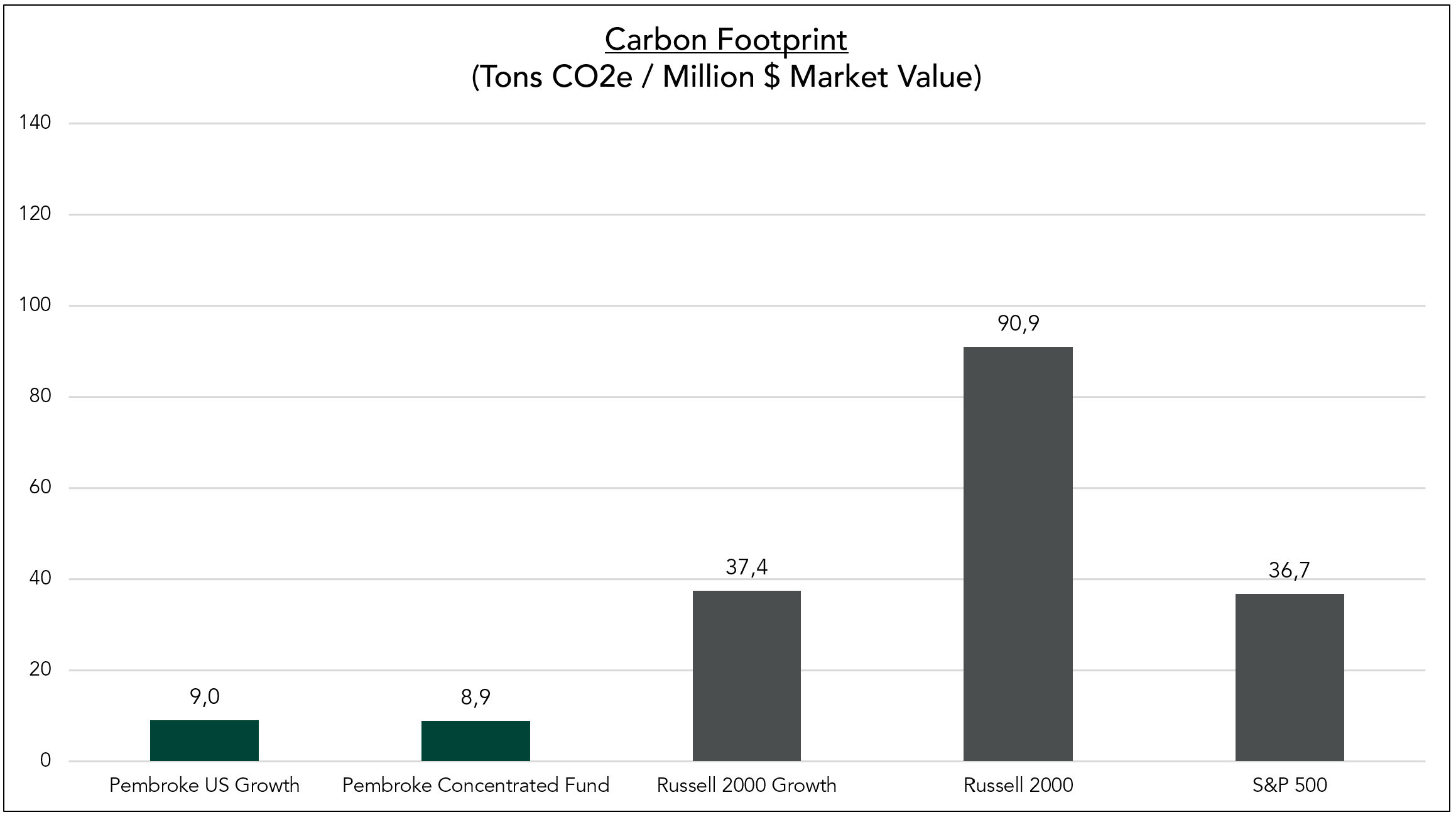

We are pleased to report that the carbon footprint for Pembroke’s internally managed equity strategies is low. This means that the carbon emissions per dollar invested in a given Pembroke strategy is significantly below the carbon emissions per dollar invested in the relevant benchmark. The carbon footprint refers to the total Scope 1 and Scope 2 carbon emissions [1] for a portfolio, normalized by the total market value of the portfolio (i.e.: tons of CO2 per million dollars of portfolio market value).

The Canadian strategies account for between 33% and 37% of the carbon footprint of the S&P TSX Index. Note that the Canadian indices have relatively high emissions. This is due to the high weighting of carbon emitting extractive industries, such as mining, oil and gas.

The Pembroke US Growth and Concentrated strategies have carbon footprints of less than 10% of the Russell 2000 index, the primary benchmark. Even the tech-heavy S&P 500 has a carbon footprint four times that of the Pembroke strategies.

[1] According to the GHG Protocol standards, Scope 1 emissions are direct GHG emissions from sources controlled or owned by the reporting organization (e.g., emissions resulting from the combustion of fuel in furnaces and vehicles). Scope 2 emissions are indirect GHG emissions associated with the purchase and use of electricity, steam, heat or cooling by the reporting organization.

Other Articles Of Interest

Disclaimer

This report is for the purpose of providing some insight into Pembroke and the Pembroke funds. Past performance is not indicative of future returns. Any securities listed herein, are for informational purposes only and are not intended and should not be construed as investment advice nor is it a recommendation to buy or sell any particular security. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Pembroke seeks to ensure that the content of this document is correct and up to date but does not guarantee that the content is accurate and complete and does not assume any responsibility for this. Pembroke is not responsible for decisions or actions taken or made on the basis of information contained in this document.