January 2024

Stocks rallied into the end of the year, driven by falling interest rates, an improving inflation picture and an increased likelihood that the US and Canadian economies will avoid a deep recession. Pembroke’s US holdings have weathered the difficult economic environment well. Companies that have experienced a decline in demand have generally focused on improving profitability, using their strong balance sheets to buy back shares or consolidate weaker competitors. Others have seen little impact on their growth, but have seen their share prices fall in response to higher interest rates and recession fears.

As investors’ concerns were replaced by optimism that interest rates will fall in 2024 and the economy will improve, small- and mid-cap stocks soared, with the Russell 2000 up 24.3% from its October lows. Predicting the future is a fool’s game, but if history is a guide, the outlook for smaller companies is positive. Indeed, valuations remain attractive relative to larger capitalization equities.

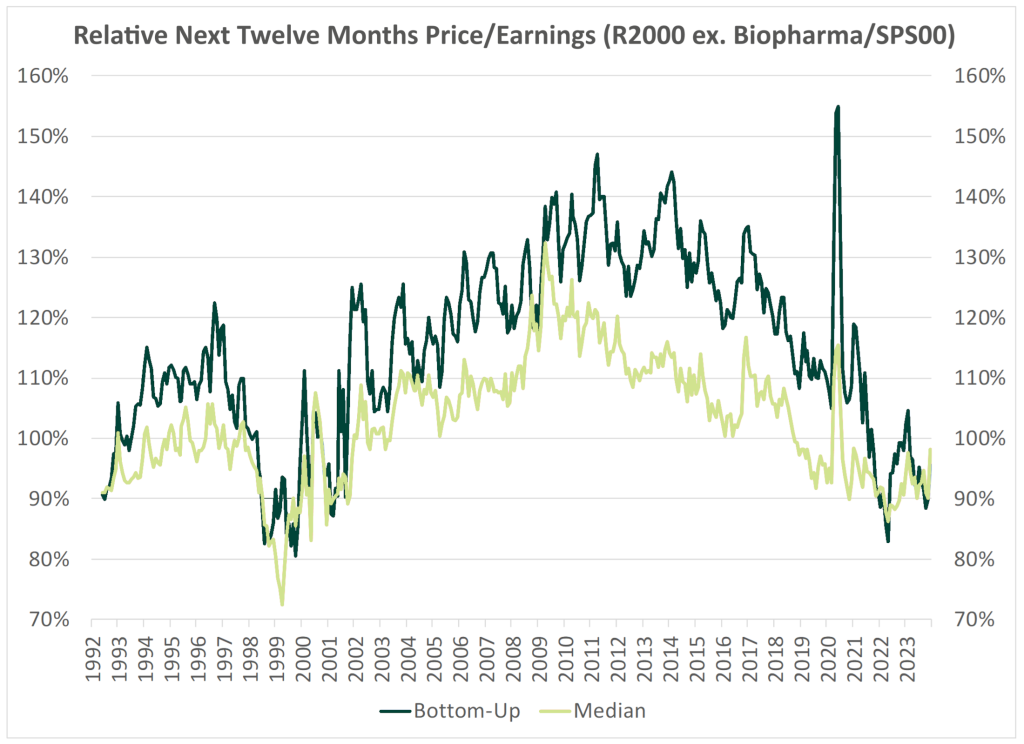

Small-Cap Relative Valuation Still Near Multi-Decade Lows

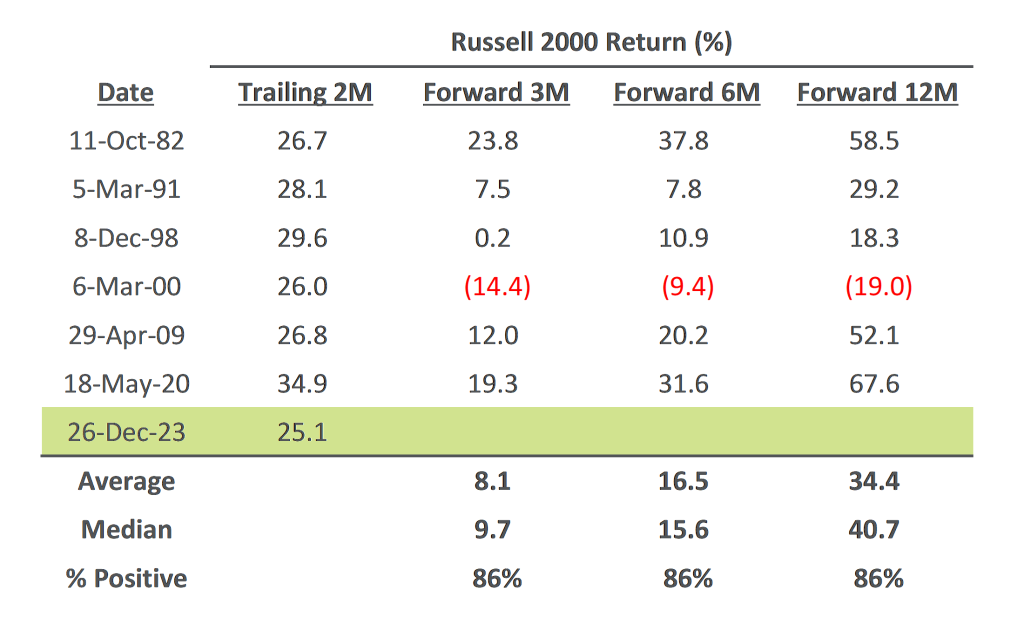

The situation can be exemplified by the fact that Apple (AAPL) was worth more at the end of 2023 than the entire Russell 2000. Typically, such extremes are not sustainable, as “trees don’t grow to the sky.” Pembroke’s managers are careful not to assume that franchises such as Apple are overvalued. They are great companies, currently positioned to create shareholder wealth over the long term. However, investor myopia and obsession with a small group of companies have led to a disconnect in valuations, and therefore opportunities in less followed areas of the market. In a more positive market environment, a broader range of companies should be rewarded by investors. In previous cycles, jumps in the Russell 2000, such as those seen since late October, have often been followed by further gains.

A Move Like We Just Saw Is Reminiscent of a New Bull Market

US Growth Strategy

Pembroke’s US Growth Strategy performed broadly in line with the Russell 2000 Index in the fourth quarter and over the past year. In the final three months of the year, strength in Information Technology, Industrials and Consumer Discretionary holdings drove much of the positive absolute performance.

The combination of a recovering economy, falling interest rates in 2024 and attractive valuations bodes well for the strategy. Nevertheless, the firm continues to invest with discipline, focusing on balance sheets, cash flow, competitive differentiation and shareholder alignment. The team seeks to invest in companies that are positioned to grow for many years and can withstand any unexpected economic or geopolitical risks.

Two stocks that made positive contributions to returns of the strategy over the past quarter

Shares of Installed Building Products (IBP) rose 47% in the fourth quarter, compared with a 14% gain for the Russell 2000 benchmark. IBP is one of the largest installers of residential insulation in the US and, as such, is heavily exposed to new home construction. In 2023, IBP benefited from a combination of strong multifamily construction, solid contribution from the company’s well-oiled merger and acquisition engine, price inflation tailwinds and margin expansion, all of which more than offset a relatively weak single-family housing backdrop. Driving shareholder interest in the fourth quarter was the macroeconomic backdrop: falling interest and mortgage rates, a healthy consumer, low unemployment and a better-than-expected economy are all supportive of the housing market and stocks like IBP. As we look forward to 2024, this macro environment combined with solid execution should allow IBP to grow free cash flow at a double-digit rate. Beyond that, we see many years of profitable growth for this attractively valued, founder-led growth stock.

Shares in Monolithic Power Systems (MPWR), a leading designer of analogue power management semiconductors, rose 37% in the fourth quarter, compared with a 14% gain in both the Russell 2000 benchmark and the tech-heavy Nasdaq Composite Index. During the quarter, MPWR benefited from bottoming signals in the broader semiconductor cycle, with inventories normalizing and demand picking up. In addition, from a sector and sentiment perspective, falling interest rates and a strong economic environment tend to help semiconductor stocks in general, and MPWR in particular. Looking at the bigger picture, we continue to see a compelling multi-year set-up for MPWR, with its sustainable competitive advantages, enormous market opportunity, high-quality business model and aligned management team.

Two stocks that made negative contributions to returns of the strategy over the past quarter

Shares in Paycom, Inc. (PAYC) fell around 20% in the fourth quarter of 2023, compared with a 14% gain for the Russell 2000 benchmark. While several factors were to blame, the market reacted negatively to PAYC’s weaker-than-expected third-quarter results and its outlook for fourth-quarter and 2024 revenue growth. PAYC is struggling with a new product launch that, while ultimately in the best interests of its customers, will result in slower revenue growth, at least through 2023 and part of 2024. While we believe management’s initial guidance for 2024 is conservative, the company does not provide sufficient detail to allow us to forecast the trajectory of revenue, margins and earnings growth in 2024. As a result, we have significantly reduced our position, but have not sold it outright. The logic for this is as follows: the company’s competitive position remains strong and unchanged; the growing pain of new product launches is finite in nature; PAYC remains the best sales organization in the sector and few things matter more in payroll/human capital management software; and the valuation is now compelling.

Energy Recovery (ERII), a global leader in pressure exchanger technology used in the desalination, wastewater treatment and refrigeration industries, had a weak fourth quarter. The company’s board announced a change in leadership that was not well communicated to the market. While an eventual CEO change was widely expected by investors, the abruptness and timing of the move created uncertainty about the company’s prospects and triggered a sharp sell-off. The company’s subsequent earnings release alleviated some of the concerns, although the company noted that higher interest rates and geopolitical instability in the Middle East were creating some uncertainty about the timing of project deliveries next year. While we remain optimistic about the company’s secular growth trends in water security and emissions reduction, we decided to redeploy the capital we had invested in the company’s shares into other opportunities with better near-term visibility and board governance.

Concentrated Strategy

Since its inception in January 2018, the Pembroke Concentrated Strategy has increased in value by approximately 11.9% per annum, compared with approximately 7.1% for the Russell 2000. Over the last year, the strategy gained approximately 15.5%, compared to a 14.2% gain in the Russell 2000. More recently, in the fourth quarter, the strategy rose 11.6%, almost exactly in line with its benchmark.

The solid performance in the quarter was driven by strength in Information Technology, Industrials and Consumer Discretionary holdings. After a difficult start to October, equities rallied towards the end of the year, driven by falling interest rates, an improving inflation picture and an increased likelihood that the US economy will avoid recession. In addition, investor sentiment was cautious, with cash on the sidelines steadily moving into equities as the quarter progressed.

At a more granular level, the strategy exhibited healthy breadth over the quarter, with approximately 75% of the portfolio increasing in value. Our largest weightings and highest conviction names showed significant strength.

Two stocks that made positive contributions to returns of the strategy over the past quarter

Shares of Installed Building Products (IBP) rose 47% in the fourth quarter, compared with a 14% gain for the Russell 2000 benchmark. IBP is one of the largest installers of residential insulation in the US and, as such, is heavily exposed to new home construction. In 2023, IBP benefited from a combination of strong multifamily construction, solid contribution from the company’s well-oiled merger and acquisition engine, price inflation tailwinds and margin expansion, all of which more than offset a relatively weak single-family housing backdrop. Driving shareholder interest in the fourth quarter was the macroeconomic backdrop: falling interest and mortgage rates, a healthy consumer, low unemployment and a better-than-expected economy are all supportive of the housing market and stocks like IBP. As we look forward to 2024, this macro environment combined with solid execution should allow IBP to grow free cash flow at a double-digit rate. Beyond that, we see many years of profitable growth for this attractively valued, founder-led growth stock.

Shares in Core & Main Inc. (CNM) rose by 40% in the fourth quarter of 2023, compared with a 14% gain for the Russell 2000 benchmark. CNM is one of the largest distributors of water, wastewater, storm drainage and fire protection products in North America and has many of the characteristics of successful Pembroke distribution investments. It sits at the nexus of an ideal industry structure, benefiting from a highly fragmented pool of customers, suppliers and competitors. CNM is attacking a huge market that is growing at around 4% to 6% organically. Additional growth comes from an active merger and acquisition engine funded entirely by internal free cash flow. Add in margin expansion from operating leverage and efficiency, and the company should deliver double-digit earnings growth for many years. These factors, combined with a reasonable valuation and a well-aligned management team, make CNM one of our higher conviction investments.

Two stocks that made negative contributions to returns of the strategy over the past quarter

Shares in Paycom, Inc. (PAYC) experienced a fall of around 39% in the concentrated strategy, compared with a 14% gain for the Russell 2000 benchmark. While several factors were to blame, the market reacted negatively to PAYC’s weaker-than-expected third-quarter results and its outlook for fourth-quarter and 2024 revenue growth. PAYC is struggling with a new product launch that, while ultimately in the best interests of its customers, will result in slower revenue growth, at least through 2023 and part of 2024. While we believe management’s initial guidance for 2024 is conservative, the company does not provide sufficient detail to allow us to forecast the trajectory of revenue, margins and earnings growth in 2024. As a result, we have significantly reduced our position, but have not sold it outright. The logic for this is as follows: the company’s competitive position remains strong and unchanged; the growing pain of new product launches is finite in nature; PAYC remains the best sales organization in the sector and few things matter more in payroll/human capital management software; and the valuation is now compelling.

Shares in WNS Holdings (WNS) struggled after posting strong results for the third quarter. The company reduced its guidance for its current fiscal year due to a delay in the ramp-up of a large contract and a slight slowdown in demand from its travel customers. However, the company still expects revenue growth of 8% to 12% and trades at a reasonable valuation. WNS shares have been under pressure for much of 2023, with investors concerned that artificial intelligence will disrupt the company’s revenue model. After extensive diligence and discussions with management, industry experts and competitors, Pembroke concluded that, as has often been the case throughout WNS’s history, technological advances are likely to help the company. Pembroke worked with management and encouraged the company to take advantage of the market’s short-term focus to buy back its own shares. On September 21, shareholders approved a buy-back of approximately 7% of the company’s outstanding shares. As growth reaccelerates and the company proves its resilience to artificial intelligence, Pembroke expects WNS shares to move higher.

Other Articles Of Interest

Disclaimer

This report is for the purpose of providing some insight into Pembroke and the Pembroke funds. Past performance is not indicative of future returns. Any securities listed herein, are for informational purposes only and are not intended and should not be construed as investment advice nor is it a recommendation to buy or sell any particular security. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Pembroke seeks to ensure that the content of this document is correct and up to date but does not guarantee that the content is accurate and complete and does not assume any responsibility for this. Pembroke is not responsible for decisions or actions taken or made on the basis of information contained in this document.