In the fourth quarter of 2018, equity markets around the world declined sharply. Even the S&P 500, which had shown resilience despite political and economic concerns abroad, fell into bear market territory (down more than 20% from its highs) on the 26th of December. American small and mid-cap companies, seen by some investors as a refuge, due to their lower exposure to foreign markets, also succumbed to selling pressure and the Russell 2000 Total Return Index fell 20.2% (in USD terms) in the final three months of 2018. Canadian equity markets were similarly hit, as both supply and demand concerns rocked oil prices. With the first month of 2019 behind us, equity markets have rebounded, and investors may be tempted to “sell the bounce”. That is, to time the market, sell, and come back when the macroeconomic and political clouds have cleared.

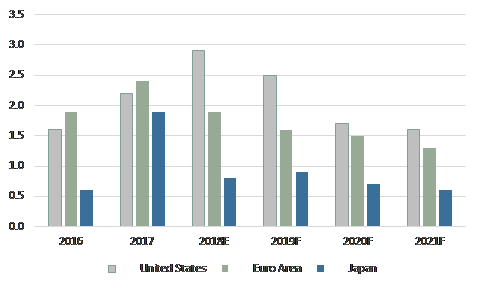

Central bank monetary tightening, the US-China trade war, the spectre of another US government shutdown, and the looming Brexit deadline are contributing to increasing fears of recession. The stock market as recently as December seemed to be predicting a recession, but then the stock market has predicted many recessions, some that have occurred and some that have not. Many economists are not predicting a recession for either the US or Canada in 2019. The World Bank, which recently published a report (“Darkening Skies”) forecast growth rates of over 1.5% in the US for 2019 and 2020 (Exhibit 1).

Exhibit 1: World Bank GDP Growth Projections

With conflicting signals from the markets and the economists, and no crystal ball, we do what we have always done: focus on company-level fundamentals, balance sheet strength, management alignment, and long-term growth opportunities. What should our clients do?

Invest for the long term. Don’t try to time markets. Diversify

Market declines like the one in the fourth quarter of 2018 are often fast and furious, quickly “pricing in” a recession and making it an inopportune time to sell. Several recent reports covering decades of data have noted that the worst quarterly stock market declines in the US and Canada have been followed by positive performance in the following one year, three years and five years. Past performance is not a guarantee of future performance and there are never “sure-things” in investing. But the historical performance data provides context and a frame of reference.

Markets have fallen sharply before; looking at past periods reminds us that legitimate investor anxiety and sharply falling stock prices can represent opportunity for the long-term investor. Pessimistic market sentiment has the potential to move quickly in the other direction. The opportunity presented by sharp market-wide downturns is to find companies with unimpaired, strong secular growth, selling at suddenly reduced valuation. The eventual recovery in valuation multiples’ alongside continued growth, can lead to meaningful stock price appreciation. Professional investors who recognize these opportunities often go on the offensive during downturns, searching for the double play of secular earnings growth trading at depressed valuations.

With more than 50 years of experience, Pembroke has been through many cycles of market euphoria and market despair. We have learned, and been humbled in the process, that timing the market rarely works. Our experience has taught us three important lessons:

- Take a long-term view – stay invested according to your financial plan and strategic asset allocation;

- Don’t try to time the markets – Instead, rebalance periodically to stay within your strategic asset allocation;

- Diversify (by region and by asset class).

If this conversation interests you and you want to learn more, please call your Pembroke representative today.

Publish Date: February 1, 2019