Introduction

During these uncertain times, we hope that you and those close to you are well. While Pembroke’s physical offices are closed due to the pandemic, our team is operating at full force from home.

We hope that you will find this reformatted version of our Pembroke Perspectives Newsletter to be both interesting and informative and we would welcome the opportunity to speak with you should you have any questions or comments.

On the Road Video Conference – COVID-19 Realization and Response

The first quarter of 2020 tested organizations around the world – how quickly could they adapt to the pandemic and to rapidly changing work conditions? The stock market, because it is so liquid and can move so quickly during times of stress, put Pembroke to the test. To understand how the firm has dealt with sharply restricted travel conditions, given the role management meetings play in Pembroke’s investment process, it is worthwhile setting the table to fully appreciate what transpired over a matter of weeks.

The first quarter of 2020 tested organizations around the world – how quickly could they adapt to the pandemic and to rapidly changing work conditions? The stock market, because it is so liquid and can move so quickly during times of stress, put Pembroke to the test. To understand how the firm has dealt with sharply restricted travel conditions, given the role management meetings play in Pembroke’s investment process, it is worthwhile setting the table to fully appreciate what transpired over a matter of weeks.

REALIZATION

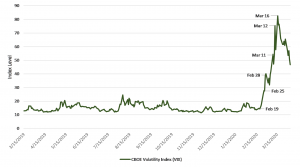

Stocks and bond trading desks, like elevators, have a maximum capacity. If everyone rushes to the doors at once, chaos ensues. Chaos and uncertainty in stock markets show up as volatility in indicators like the VIX – the Chicago Board Options Exchange’s Volatility Index, which indicates near-term volatility based on prices of S&P 500 Index. Of course, in normal market conditions, everyone does not rush to the doors at once. In normal conditions, savers continue to provide their capital to investors, investors commit that capital to entrepreneurs and their companies, and those companies invest that capital in the pursuit of growth and expansion.

Until February, there remained a broad, if fragile, consensus that global growth and expansion were still possible. After several quarters of economic uncertainty stemming from trade tariffs, supply chain disruptions, and manufacturing declines, it still seemed possible, with full employment in the US and improving employment in parts of Europe, that the strength of global consumption might fuel a sustainable recovery in economic growth. That is not to say there were no risks. Earnings growth had slowed, and valuations were high in many markets. China’s economy had clearly suffered from the COVID-19 virus outbreak, but the country appeared to be on the path to recovery. On February 19th, with the S&P 500 at an all-time-high, the VIX Index closed slightly below its average level for the past year (Exhibit 1).

Over the weekend of February 22nd, a collective realization seemed to spread across the world: the virus had entered Europe and would not be containable. By the end of the next week, the VIX index of volatility had more than doubled. The consensus had broken, the continued growth scenario was off the table, and investors were rushing for the doors.

Exhibit 1: Chicago Board Options Exchange’s Volatility Index, Trailing 12 Months

Source: Bloomberg

The deluge of selling triggered circuit breakers in stock markets all over the world – temporary halts in trading put in place to arrest either panic selling or excessive buying. By mid-March, with the virus having been declared a global pandemic by the World Health Organization, and businesses and schools around the world closing, volatility surged to a record high. The collective worldview of economists and investors had flipped in just three weeks from continued global growth, to a deep recession with record unemployment and deflation hastened by an ill-timed breakdown of the OPEC oil cartel’s production discipline.

RESPONSE

The simultaneous pandemic and stock and bond market collapse created a unique challenge for investment firms: as the biggest volatility event of their careers hit, analysts and fund managers were being told, not asked, to grab their belongings (now), leave the office (now), and work remotely. This was an unexpected test with, perhaps, an equally unexpected outcome.

One consequence of the 2008-2009 financial crisis is that investment firms around the world invested massively in enterprise risk management including remote data and file storage, videoconferencing, telecommuting, and remote client portal technology, disaster preparedness, and business continuation. Pembroke was no exception, and all that work, and all those investments paid off in just the past few weeks. While Pembroke is a financial services company, and therefore an essential service by government standards, the firm’s executive committee still ordered all personnel to work from home wherever possible.

By March 11th, Pembroke employees were working remotely. We adopted Microsoft Teams to ensure constant interaction and easy videoconferencing. The regular investment meetings continued unabated, and new meetings were added to ensure that the lines of communication remained fluid. The reaction across the firm was impressive and almost seamless. The question quickly became whether we would be able to communicate with our portfolio holdings to better assess their situations. Again, the response has been impressive. Over the past six weeks, Pembroke analysts and portfolio managers have spoken with most of our holdings and many of their peers and suppliers. The big difference this time is that, instead of going on the road, as we usually do, we are holding videoconference calls from our homes. The irony is that we find ourselves in closer contact with our holdings than ever before.

Technology has allowed us to be “on the road” even as this crisis has limited our ability to travel. Our calls with management teams are all about understanding how they are weathering this crisis, both from a revenue and a balance sheet perspective, and how they think their long-term plans have been altered. Our companies are not just stock prices fluctuating on our screens. Like Pembroke, they are real enterprises that adapt to changing circumstances. In many cases, the volatility of their stock prices is related to the panic of investors rather than to the company’s ability to manage through this crisis. Many of our companies are using technology to meet their customers’ needs, persevering through a temporary restriction on the movement of people and goods, and are supported by strong balance sheets and experienced management teams.

In the history of writing Pembroke’s Perspectives quarterly newsletter for our clients, we have never experienced such a six-week period as this one. We take comfort, nevertheless, in the fact that our portfolio companies are well-positioned to survive this crisis and thrive when it has passed. Human innovation will continue, and the organizational cradle for much of the world’s innovation remains the small to medium-sized company. That is why Pembroke has focused for over fifty years on small to medium sized growth companies as the foundation for long-term wealth creation.

Our philosophy remains the same as does our advice to our clients: take a long-term view, diversify, and never try to time markets. We cannot forecast when the recovery will begin but we can position for it and we are doing so. If you are working with a financial advisor, this is an ideal time to review your portfolio and long-term strategy. If you would like to meet with your Pembroke representative to discuss any of the Pembroke investment strategies, we are available and ready to take your call. As soon as we can get back on the road, we will be visiting companies again, turning over new ideas, and meeting with you to share our passion for growth investing. In the meantime, we will continue to make great use of videoconferencing technology and the telephone.

Investment Commentary & Outlook

During these unprecedented and trying times, we send our wishes for health and happiness to all our clients and friends. While the economic ramifications of the COVID-19 pandemic are significant, these trying times certainly highlight the importance of family and friends in our lives. We also want to assure you that Pembroke continues to operate without interruption, even as we work from home. The investment team, the client service team, and the operations team are all employing technology to ensure efficient communication between colleagues, our clients, the companies we invest in, and our service providers. As an essential service, we remain fully operational and available to assist you. Stay safe; we look forward to seeing you all in person as soon as is reasonably possible.

Just weeks ago, investors were celebrating all-time new highs for North American equity markets. Pembroke’s portfolios were up on an absolute basis, and most were ahead of their benchmarks. Then COVID-19 struck. It had been lingering in the background of the news cycle since the beginning of 2020, but the risk it posed to human lives and the global economy only started to become apparent as we entered February and March. The measures being taken to slow the spread of the disease will have a significantly negative impact on economic activity and corporate profits. It is a choice by society to live through a temporary shutdown to save as many lives as possible. Certainly, we have lived through major recessions, financials crises, and even wars, but a global economic shutdown of this magnitude is new territory for most investors. It is too easy to say that this is just a selling panic being fueled by the 24/7 connected society and short-term traders. The reality is that the outcome is uncertain, and as portfolio managers we must manage accordingly.

As stewards of your capital, what are we doing as we face this unprecedented challenge? First, we are focused on the balance sheet strength of our holdings. In fact, this has been the case for over two years. As a result, the overall debt levels of the portfolios are significantly below those of our benchmarks. Second, we have heard from most portfolio companies in recent weeks. In general, we are pleased to report that because of their significant ownership, our executives are thinking like owners through this crisis; they are balancing short-term challenges with long-term opportunities. In fact, while we are asking the companies how they plan to manage through the crisis, we are also asking them how they might go on the offensive and be in an improved competitive position coming out of the crisis. Finally, as is often the case in crises, correlations between assets tighten. In other words, all stocks are down, so this is a good time not only to concentrate capital in our portfolios’ long-term winners but also to buy stocks we have always liked but determined were too expensive in the past.

Despite the “newness” of this crisis, we are reviewing historical events to look for patterns. Mark Twain is reputed to have said, “History doesn’t repeat itself, but it often rhymes.” For now, we believe parallels to the Great Depression are not appropriate, as recent measures taken by central banks and governments around the world are very different from the restrictive policies of that era. We also have great faith in the efforts of medical professionals around the world to find a cure for this illness. There is no doubt, however, that we are entering a recession, if we have not already. Parallels to other deep recessions of the past, including the 2008/2009 financial crisis, may therefore provide insight as to what company-level characteristics will protect capital during this downturn, and which characteristics are typical of companies that will lead us out of the bear market. We are, therefore, combining the detailed bottom-up analysis of our holdings with an analysis of past bear markets and recoveries in order to position our portfolios and take advantage of the eventual recovery.

We own high-quality, growing companies. Most will certainly not grow as quickly as originally expected this year, but they should rebound out of the crisis. The exact timing of a turn in the stock market is impossible to forecast, but North American equity markets are already deeply into bear market territory, especially smaller capitalization stocks. In fact, the Russell 2000’s decline in the first quarter of this year was the index’s worst quarter on record. Our belief is that our companies’ strong balance sheets and market positions will help them survive this dislocation and put them in position to go on the offensive when the smoke clears. While these are challenging times for us, for our clients, and for the management teams of our holdings, we trust that the shareholder-oriented executives running our businesses will make informed decisions to preserve and enhance shareholder value. We remain excited about the powerful secular trends within such sectors as information technology, healthcare, and consumer discretionary that will continue to produce exciting investment opportunities, many of which have been made more compelling by recent stock market declines. We do not expect the long-term moves toward the electrification of the car market to cease, we do not expect the shift towards software hosted in the cloud to slow, and we do not expect any deceleration in the market share gains of e-commerce over bricks and mortar retailing.

The COVID-19 virus may delay, or in some cases accelerate, such changes, but these secular trends are already well-entrenched and will not be arrested. At the same time, travel habits may change, with on-site visits replaced by video conferencing, and the use of large hospitals might diminish in favour of telemedicine and at-home care. Movie theaters and other high-density leisure and entertainment formats may face a secular decline in demand. Pembroke’s team is examining these risks as well as the opportunities, identifying growth companies that are being thrown by the wayside with all equities. Expect to see changes in our portfolios as we increase our weight in some holdings and add new holdings that we previously determined were too expensive.

Stock-market selloffs often represent tremendous buying opportunities. At the time of the 2008/2009 financial crises, it felt like there was no clear end and that the economy would continue to reel. Backs against the wall, governments, central banks, and citizens rallied and improvised until solutions were found. Pembroke believes that the world will recover from COVID-19, as we did from prior plagues, wars, and recessions. Aggressive and coordinated actions by central banks and governments indicate that political leaders understand the seriousness of the situation and are committed to supporting and helping re-build the economy. Scientists and doctors are also working tirelessly to find a cure. These high-level factors underpin our broad belief that there is light at the end of the tunnel. Further, powerful trends in technology, healthcare, and consumerism will move forward, and well-financed, well-managed companies at the forefront of those changes will emerge from this crisis ready to grow and prosper. In fact, some companies have telegraphed their confidence by announcing significant share buybacks. We are examining our holdings through the same lens as always, with added emphasis on balance sheets and competitive positioning, and taking actions that improve the portfolios’ quality and risk-return characteristics in the face of this nearly unprecedented pandemic.

To learn more about how the portfolio management team has navigated this turbulent period, listen to a replay of our virtual lunch meeting focusing on North American equities.

Canadian Equity Strategies

CANADIAN GROWTH EQUITY STRATEGY – Q1 PORTFOLIO COMMENTARY

Pembroke’s Canadian equity portfolios declined in the first quarter of 2020 as fallout from the COVID-19 pandemic ended the 11-year bull market in global equities. The rapid spread of the virus from China to western countries and the subsequent implementation of strict containment measures has led to an abrupt and drastic slowdown in economic activity. The violent equity market selloff reflects an anticipated collapse in corporate earnings and cash flow generation, widespread financial stress, and ongoing uncertainty as to the severity and duration of the COVID-19 outbreak.

While market weakness was broadly based, small cap stocks fell more than large cap stocks. Pembroke’s Canadian equity mandates underperformed the S&P/TSX Composite Index during the period, while performance was in-line with the S&P/TSX Completion Index and ahead of the S&P/TSX Small Cap Index. From an industry group perspective, investments in the consumer discretionary, financial, energy, and communication sectors declined the most during the quarter.

Two stocks made notable positive contributions to returns during the quarter:

Shares in Kinaxis, (“KXS”), a cloud-based provider of concurrent supply chain planning software based in Ottawa, increased during the quarter. In light of the Coronavirus outbreak, investors embraced 1) the value that the RapidResponse platform (Kinaxis’ flagship product) brings to their clients – which are mostly large, global enterprises with complex supply chain operations, 2) their ability to continue to grow profitably as a result of their strong backlog, and 3) a very healthy balance sheet. In the upcoming quarters, it is reasonable to assume that some customers will delay installing KXS’ solutions as they deal with pressing challenges in their businesses, but management believes that COVID-19 is a net positive for Kinaxis’ products over the long-term as companies have realized the importance of concurrent planning in remedying supply chain disruptions. In the meantime, Pembroke is willing to look through a temporary slowdown in Kinaxis’ implementation schedule, as the company’s 2020 results do not materially change the company’s intrinsic value.

Shares in Goodfood (“FOOD”), a market-leading, high growth Canadian meal-kit solutions and online grocery company, delivered first quarter gains as the current “stay-at-home” dynamic spurred by COVID-19 led to a surge in demand for meal-kit and grocery delivery services. Goodfood is now appealing to many segments of the population that were previously not subscribing to meal kits; and is doing so without incurring additional marketing costs. While it is still too early to quantify the financial impacts, the company has noticed an uptick in demand across all its product offerings resulting in higher order value and frequency. The company’s operations have been deemed an essential service by the government and the company is benefitting from increased labour availability. Furthermore, we do not foresee significant supply chain disruptions over the short-term as the company secures some 80% of food items directly from local Canadian farms. With a strong balance sheet following a recent financing, the company is well-positioned in this uncertain environment. FOOD’s two founders remain its largest shareholders.

Two stocks made notable negative contributions to returns during the quarter:

Shares in BRP (“DOO”), a manufacturer, distributor, and marketer of recreational powersport and marine products worldwide, declined sharply in the first quarter as COVID-19 containment efforts led to a spike in unemployment, a drastic decline in disposable income, and a weaker outlook for consumer discretionary spending. While fourth quarter results were ahead of expectations and first quarter demand prior to the outbreak had been strong, near-term headwinds brought about by COVID-19 have disrupted those trends. The company has undertaken swift capital preservation measures in response to the crisis, including shuttering production facilities, cutting fixed expenses, reducing capital expenditures, and drawing on its revolving credit facilities. With debt maturities extended to 2027 and flexible debt covenants, we expect BRP to navigate the downturn and emerge in a competitively stronger position once demand recovers.

Shares in Sleep Country Canada (“ZZZ”), a leading Canadian specialty mattress retailer operating in 270 locations across the country and online, were weak in the first quarter as the company closed its stores for the protection of its employees and clients. While the duration of the store closures remains uncertain, the company continues to sell via the internet, has adequate financial flexibility to weather the storm, and expects to utilize government programs to support its employees. Ultimately, we believe Sleep Country is positioned for market share gains given its capital light business model, deep relationships with manufacturers, and superior competitive position compared to department stores and smaller privately-owned businesses with more precarious financial situations.

DIVIDEND GROWTH EQUITY STRATEGY – Q1 PORTFOLIO COMMENTARY

The Pembroke Dividend Growth Fund is a Pooled Fund. This is a prospectus-exempt product that is only offered to investors who meet the definition of an “accredited investor” under securities legislation.

Economic activity decelerated sharply in Canada as measures implemented to contain the virus have greatly slowed or altogether stopped the operations of many businesses. Equity market sentiment turned decidedly negative with corporate earnings and cash flow generation impaired in the near-term.

Market weakness affected all asset classes, although larger, more liquid stocks showed relative strength compared to smaller stocks with less liquidity. In this environment, the Pembroke Dividend Growth Fund underperformed the S&P/TSX Composite Index during the period, while performance was ahead of both the S&P/TSX Completion Index and the S&P/TSX Small Cap Index. Notably, the fund also outperformed the S&P/TSX Dividend Aristocrats Index during the quarter. From an industry group perspective, investments in the consumer discretionary, financial, industrial, energy, and communication sectors declined the most during the period.

Two stocks made notable positive contributions to returns during the quarter:

Shares in Metro (“MRU CN”), a Canadian grocery and pharmacy operator with locations across Québec and Ontario, posted gains in the first quarter as the company provides essential services through the COVID-19 crisis. All Metro locations have remained open and have experienced accelerated sales as consumers avoid eating at restaurants. The average basket size has also increased as consumers have stocked reserves of necessities. The company is meeting demand by increasing the capacity of its stores and testing the robustness of its supply chain all while ensuring the safety of its employees and clients. The company has increased the wages of its store and distribution centre employees during this period. We would expect the remaining synergies from the Jean Coutu acquisition to be postponed in this environment.

Watsco (“WSO US”), a leading North American distributor of air conditioning, heating, and cooling (HVAC) equipment, was a top contributor to the fund in the first quarter of 2020 as we opportunistically initiated a position in the company during the COVID-19 selloff. While Watsco is seeing some disruption in business as a result of outbreak containment measures, the servicing and maintenance of HVAC systems are critical matters and cannot be deferred for long. The company has a long record of generating free cash flow and growing its dividend and is positioned to consolidate its leadership position in the industry through the downturn by making acquisitions and by widening its technological lead over its competitors.

Two stocks made notable negative contributions to returns during the quarter:

Shares in Sleep Country Canada (“ZZZ CN”), a leading Canadian specialty mattress retailer with over 270 locations nationwide and an e-commerce platform, were weak in the first quarter as the company shuttered its stores in line with COVID-19 social distancing protocols. Sleep Country continues to sell products on the internet and has adequate financial capacity to persevere until its stores reopen. We believe that the company will emerge from the COVID-19 crisis in better shape than its competitors, which tend to be smaller, privately owned businesses with weaker financial resources and inferior manufacturer relationships.

Shares in Canadian Western Bank (“CWB CN”), a financial services organization offering deposit and lending products to small-and-medium sized companies and individuals, declined sharply in the first quarter. The economic fallout from the COVID-19 outbreak presents many challenges for the banking industry, including increased credit losses, an unfavorable interest rate environment, and headwinds for future loan growth. Moreover, CWB’s exposure to the Alberta economy presents an additional challenge given the weakness prevalent in the energy sector. CWB is, however, very well positioned to navigate the turmoil. Its balance sheet is well capitalized, and underwriting standards were very stringent following the 2008 financial crisis and the 2015 energy slump. The company has spent years developing its technological platform and has the support of regulators to move to a risk management framework that will improve its competitive positioning versus larger banks. Despite near-term volatility, CWB’s longer-term growth prospects remain intact.

To learn more about how the portfolio management team has navigated this turbulent period, listen to a replay of our virtual lunch meeting focusing on North American equities.

Please note that the names of the Canadian equity funds have changed to unify the Pembroke and GBC brands. All funds now start with Pembroke, and the pooled funds for accredited investors include the word Pooled. The GBC Canadian Growth Fund is now called the Pembroke Canadian Growth Fund. The Pembroke Dividend Growth Fund is now called the Pembroke Dividend Growth Pooled Fund. The Pembroke Canadian Growth Fund is now called the Pembroke Canadian Growth Pooled Fund.

US Equity Strategies

US GROWTH EQUITY STRATEGY – Q1 PORTFOLIO COMMENTARY

After a strong start to the year, the market turned sharply lower as investors fled equities amid the economic shutdown caused by COVID-19. In this environment, less liquid small-cap securities declined more than larger capitalization stocks. The Russell 2000 dropped (30.6%) in the first three months of 2020, its worst absolute quarter in history, and underperformed the S&P 500 by 11%. In fact, the Russell 2000’s trailing 52-week return relative to the S&P 500 hit its lowest level since 1999. Pembroke’s view is that in many cases, the relatively greater decline of smaller capitalization companies reflects lower liquidity rather than higher risk and is typical of recessions. Fortunately, history also points to superior gains for smaller capitalization equities as the economy recovers. Small-cap strategist Jim Furey highlights that following the worst 20 quarters in the Russell 2000’s history (prior to the first quarter of 2020), the following year’s returns averaged 24%, were positive 84% of the time, and beat the performance of large-capitalization stocks 79% of the time. We will only know a year from now whether this trend continues, but the record supports our view that the current downturn presents patient, long-term investors an opportunity.

In the first quarter of 2020, Pembroke’s US portfolios outperformed the Russell 2000, but given the depth of the downturn, the relative gains felt like a Pyrrhic victory. While the firm’s focus on balance sheet strength and secular growth contributed to our relative results, the underlying businesses of some resilient growth companies were dramatically affected by the unique nature of this slowdown. For example, business outsourcing companies, some of which offer high cash flow and persistent revenue and even help their customers reduce costs during recessions, have had to move their workforces (numbering in the tens of thousands) to a work-from-home model, causing significant near-term disruptions. This is just one example of why it has been different this time. When the world’s workforces start to return to their jobs and the economy accelerates, however, we still expect companies with entrenched competitive positions, strong balance sheets, and large market opportunities to outperform companies that went into this downturn on a weaker footing. Our current focus is on identifying areas of strength within the portfolio and focusing client capital on those opportunities. We recently decided to expand our 30% sector limit to 35%, allowing our investment team more freedom to allocate funds to areas like information technology that offer the most compelling risk-reward profiles and meet our standards for balance sheet strength and growth.

Two stocks made notable positive contributions to returns during the quarter:

Shares in home health and hospice provider Amedysis (“AMED”) rose in the first quarter of 2020 as investors focused on the non-cyclical nature of demand and the benefits of keeping patients out of hospitals. The company is also benefiting from favourable pricing legislation passed by the US government in 2019, averting a profitability squeeze that had been worrying investors. At the same time, Amedysis management has a strong record of consolidating smaller competitors, and complexities introduced in the recently passed legislation may force many of these outfits to consider selling themselves at terms favourable to larger companies such as Amedysis. Certainly, the tragedy of COVID-19 highlights the benefits of keeping patients at home, which should propel long-term growth in Amedysis’ end markets.

Shares in new holding Five9 (“FIVN”) rose slightly from Pembroke’s initial purchase price. The company provides cloud contact center software, including real-time reporting, recording, quality monitoring, workforce management, and customer relationship management integrations. While COVID-19 wreaks havoc on the global economy, companies around the world are investing in their contact centers to stay in touch with customers and protect their brands. The company is seeing demand for accelerated implementations in certain cases. On a longer-term basis, Five9 has established itself as the technology leader in this area, taking share from large incumbents. Management is committed to both rapid revenue growth and significant profit margin expansion and has a record of delivering both. Pembroke’s investment team has followed the company for years, becoming increasingly impressed with Five9’s leadership position, product suite, and execution.

Two stocks made notable negative contributions to returns during the quarter:

The stock price of long-time holding Franklin Covey (“FC”) declined in the first quarter of 2020 as investors fretted about the sustainability of the company’s growth rate if faced with a major recession. The company’s stock is also not particularly liquid, due to significant insider ownership and a stable shareholder base. The rush for the exit by other shareholders, therefore, may have unduly pressured the stock. FC provides leadership training and organizational consulting to executives around the world. In recent years, it has successfully moved much of its revenue base to a recurring subscription model. The accounting implications of this shift masked the company’s true profitability, but FC is now delivering a combination of growth, profit margin expansion, and free cash flow. The company’s recent results, issued just after quarter end, indicated solid achievement of its objectives, with subscription revenue growing 28% over last year. While some of its clients will be hurt by the COVID-19 outbreak and short-term revenue growth will slow compared to prior expectations, the long-term opportunity for FC to win new mandates, grow share within existing customers, and launch new offerings remains unchanged. Pembroke has used recent weakness to add to its position.

Shares in Woodward (“WWD”), which sells energy control systems for the aerospace industry and propulsion components for industrial engine systems, declined 50% in the first quarter compared to a 31% decline in the Russell 2000. WWD under-performed the market as COVID-inspired fears and demand destruction impacted the broader airline and aerospace markets. Woodward was particularly affected given its previously announced intent to merge with Hexcel, a business that would have doubled its aerospace exposure. Following the end of the first quarter, Woodward and Hexcel announced the mutual termination of their transaction, better positioning the company for recovery. Its exposure is now more heavily weighted towards healthier segments of the aerospace market, and the diversifying benefits of its industrial business unit are more pronounced. We are maintaining our holding in the stock given the company’s long-term growth potential, sizable market positions, differentiated technology, and very favorable current valuation. While any debt is too much debt coming into a seismic shock like COVID-19, WWD has ample liquidity, reasonable covenants, and no maturities until late 2024.

During the first quarter ended March 31, 2020, The Pembroke Concentrated Fund remained a Pooled Fund, a prospectus-exempt product offered only to investors who meet the definition of an “accredited investor” under securities legislation. During early April 2020, the Pembroke Concentrated Fund was converted from a pooled fund into a mutual fund. This change allows investors who are not considered as accredited investors to have access to this strategy.

CONCENTRATED GROWTH EQUITY STRATEGY – Q1 PORTFOLIO COMMENTARY

The Pembroke Concentrated Fund declined by 20.1% during the quarter, outperforming its benchmark the Russell 2000 Index which declined by 24.2% during the quarter. Given the magnitude of the benchmark’s decline during the quarter, the concentrated fund’s excess return of over 4%, with only 17 holdings, is a testament to the strategy’s strict discipline and focus on only the highest quality growth companies. Since its inception on January 31, 2018, the fund has gained 2.79% while the Russell 2000 Benchmark has declined 6.1%, an excess return of 8.9%.

The main source of excess return during the quarter was the fund’s overweight allocation to information technology companies – eight of the fund’s 17 holdings at quarter-end and nearly half the weight of the fund. The fund also benefitted relative to the index from the performance of its healthcare companies. Altogether, information technology and healthcare companies accounted for over 70% of the fund’s weight at quarter-end. The remainder of the fund was allocated to three consumer-discretionary and three industrial companies. The fund’s zero allocation to energy and materials also contributed to positive relative performance. Approximately 88% of the fund was invested in the US at quarter-end and 12% in Canada.

Two stocks made notable positive contributions to returns during the quarter:

Shares in MongoDB Inc (“MDB US”) gained during the quarter. The company, a general-purpose data platform with thousands of customers in over 100 countries, announced strong fourth quarter and full year revenue growth from both its service and subscription businesses. The company is positioned for a major shift in the database market over the next decade toward the cloud.

Shares in Kinaxis, (“KXS CN”), a cloud-based provider of concurrent supply chain planning software based in Ottawa, increased during the quarter. In light of the Coronavirus outbreak, investors embraced 1) the value that the RapidResponse platform (Kinaxis’ flagship product) brings to their clients – which are mostly large, global enterprises with complex supply chain operations, 2) their ability to continue to grow profitably as a result of their strong backlog, and 3) a very healthy balance sheet. In the upcoming quarters, it is reasonable to assume that some customers will delay installing KXS’ solutions as they deal with pressing challenges in their businesses, but management believes that COVID-19 is a net positive for Kinaxis’ products over the long-term as companies have realized the importance of concurrent planning in remedying supply chain disruptions. In the meantime, Pembroke is willing to look through a temporary slowdown in Kinaxis’ implementation schedule, as the company’s 2020 results do not materially change the company’s intrinsic value.

Two stocks made notable negative contributions to returns during the quarter:

Shares in BRP (“DOO CN”), a manufacturer, distributor, and marketer of recreational powersport and marine products worldwide, declined sharply in the first quarter as COVID-19 containment efforts led to a spike in unemployment, a drastic decline in disposable income, and a weaker outlook for consumer discretionary spending. While fourth quarter results were ahead of expectations and first quarter demand prior to the outbreak had been strong, near-term headwinds brought about by COVID-19 have disrupted that trend. The company has undertaken swift capital preservation measures in response to the crisis, including shuttering production facilities, cutting fixed expenses, reducing capital expenditures, and drawing on its revolving credit facilities. With debt maturities extended to 2027 and flexible debt covenants, we expect BRP to navigate the downturn and emerge in a competitively stronger position.

The shares of Euronet Worldwide (“EEFT US”) declined during the quarter. The company provides secure electronic financial transactions (EFT) solutions including a global payment network for prepaid mobile top-up, a global money transfer company, and an independent international ATM network. With clients in some 170 countries, the company announced that global population movement restriction measures had resulted in decreases in business transactions in some areas (international transactions in the EFT business) and increases in other areas (the money transfer segment). The impact on the electronics payments business has so far been mixed with some negative impacts in areas where population restriction measures are in place and some positive impacts from increased use of mobile devices, streaming, and gaming. The company prudently announced in March that first quarter results could not be reasonably estimated, and it withdrew its previously issued first quarter guidance.

To learn more about how the portfolio management team has navigated this turbulent period, listen to a replay of our virtual lunch meeting focusing on North American equities.

Please note that the names of the US equity funds have changed to unify the Pembroke and GBC brands. All funds now start with Pembroke, and the pooled funds for accredited investors include the word Pooled.

The GBC American Growth Fund is now called the Pembroke American Growth Fund.

The Pembroke US Growth Fund is now called the Pembroke US Growth Pooled Fund.

The Pembroke Concentrated Fund is now called the Pembroke Concentrated Fund (the word “the” has been removed from the name).

International Equity Strategies

Heightened concerns surrounding the spread of COVID-19 and the extent of its economic impact are driving significant volatility across asset classes globally. At this point the full impact on the global economy is unknowable, as it depends on the duration and strength of the quarantine now in effect across many locations in Europe and the United States.

The economic impact in China may serve as a benchmark for the scale of economic disruption, and the impact is colossal. Industrial production declined by 13.5% year-over-year in January and February. Retail sales and auto sales (included in overall retail sales) declined by 20.5% and 37.0%, respectively, during the same period. Now that the peak of the outbreak seems to have passed in China, economic growth is starting to recover, albeit at depressed levels.

The root cause of the market uncertainty is the continued rise in the number of new cases worldwide. While estimates for the ultimate spread of the virus are uncertain, it appears that Italy is following China with a two- to three-week lag, while the United States is a further two weeks behind.

While the damage to the economy is sure to be substantial, monetary policy is providing substantial liquidity, reducing a risk of a funding crisis. Fiscal policy is certain to follow as measures designed to support the economy are already in the works across the globe. Knowing the specifics of this stimulus will be increasingly important to determine which companies and industries are better positioned to navigate the downturn.

For China, the full brunt of the decline is likely to be borne in the first quarter of 2020, while for both Europe and the United States the lowest levels of activity are likely to be during March and April. This means that GDP contraction (recession) is likely to be spread over at least the first and second quarters of 2020. Projected US gross domestic product (GDP) ranges widely in the second quarter; but has the potential to be the largest downdraft since data has been recorded.

INTERNATIONAL SMALL CAP GROWTH EQUITY STRATEGY – Q1 PORTFOLIO COMMENTARY

The Pembroke International Growth Fund (previously known as the GBC International Growth Fund) outpaced its benchmark (the MSCI ACWI ex-US Small Cap Index) during the quarter ended March 31. The fund’s emphasis on high quality companies with strong financial positions bolstered relative performance amid the market correction. Stock selection in the industrials and information technology sectors was a key driver of outperformance. The overweighting to information technology stocks and underweighting to energy stocks also contributed positively to relative performance.

Two stocks made notable positive contributions to returns during the quarter:

Within Industrials, Japanese maintenance, repair and operations company Monotaro (“3064 JP”) was the top contributor during the quarter. Monotaro offers over 10 million products across seven industrial categories using a single transparent price for each product and overnight delivery. The company’s success is its ability to focus on price, selection and convenience for its customers. The company leverages its extensive customer data base to predict client order trends, apply targeted promotions, and manage inventory. This strategy allows for the increase of order frequency among retained customers. The internet focused platform (90% of orders) also keeps operating expenses low relative to competitors.

Within the information technology sector, German software company Teamviewer (“TMV GR”) was the top contributor, as the share price strengthened on the improving demand outlook for remote working solutions amid the coronavirus outbreak. Teamviewer’s cloud-based connectivity platform delivers online remote control, access, and collaboration across different operating systems. The company has benefited from its ‘freemium’ model, driving massive product adoption and superior user economics on low customer acquisition costs. We expect Teamviewer’s total addressable market (TAM) to triple in the next three years, supported by broadening structural demand for digitizing processes, the internet of things, and future of work.

Two stocks made notable negative contributions to returns during the quarter:

Within staples, UK premium beverage mixers company Fevertree (“FEVR LN”) detracted from performance. The company reported weaker than expected fourth quarter revenue and reduced its outlook for revenue growth in 2020. Management noted tough comparisons, weaker consumer confidence, and greater competitive intensity within the core UK business during the holiday season. Management decided to reduce price points in the US, leading to expected deceleration in revenue growth in the US from over 30% to low-single digits in 2020.

Within the healthcare sector, Ryman Healthcare (“RYM NZ”) detracted from results due to concerns about the impact of coronavirus on business operations, as management withdrew its profit and build rate guidance following stricter government measures to combat the outbreak. Ryman operates 32 retirement villages consisting of 9,781 units and beds across New Zealand and Australia. Ryman has a unique business model among elderly care companies in that it offers the continuum of care and is a low-cost provider despite having a strong brand reputation due to its vertical integration. The company also enjoys economies of scale because the average size of a Ryman retirement village is roughly twice the size of its competitors, and this enables Ryman to operate more efficiently and to offer more services than its peers.

In the current market downturn, the performance of our international portfolio has been supported by our high-quality bias. We remain steadfastly focused on seeking opportunities to add to our best ideas, looking beyond transitory virus-related business effects. We are particularly interested in high-quality growth companies that have been out of our reach purely from a valuation perspective, as well as high-quality cyclicals that have witnessed significant declines but have the wherewithal to navigate the current crisis.

We are also stress-testing companies using a common set of reference points. As investors in high-quality growth companies, we believe our portfolios are positioned well, but it is still critical to test all of the companies in our high-quality universe, particularly those at the epicenter of the crisis, to determine which will make it through, which will need to raise equity, and which may fail to make it through the crisis.

We are spending considerable time estimating how deep the drawdown will be, as well as analyzing what the economic recovery may look like across the globe, making updates as new information becomes available.

To learn more about how the portfolio management team has navigated this turbulent period, listen to a replay of our virtual lunch meeting focusing on international equities

Please note that the names of the international equity fund has changed to unify the Pembroke and GBC brands. All funds now start with Pembroke, and the pooled funds for accredited investors include the word Pooled. The GBC International Growth Fund is now called the Pembroke International Growth Fund.

Fixed Income & Balanced Strategies

CANADIAN BOND STRATEGIES – Q1 PORTFOLIO COMMENTARY

The COVID-19 pandemic has had a staggering impact on the global economy. Certain industries have seen their revenues drop to almost zero and this cessation in business has led to mass layoffs. When coupled with plummeting oil prices, oil producing nations like Canada have been especially hard hit. The Canadian Government has responded with a series of financial and tax relief measures that are unprecedented in peacetime. This effort has been supplemented by various actions by the Bank of Canada to improve liquidity in financial markets.

While the focus was on equity markets that were down over 20% in the quarter, in the bond market, government and corporate bond yields moved in opposite directions. This caused significant widening in credit spreads and substantial underperformance in corporate bonds compared to governments. The corporate bond underperformance was correlated with credit quality and lower rated bonds were the worst performers. The Canada Index returned 5.7% in the quarter with falling government yields and the corporate index was down -2.5% on widening spreads. The BBB Index was the worst performer, with a ‑4.2% return.

Pembroke Canadian Bond Fund Commentary

The Pembroke Canadian Bond Fund (previously known as the GBC Canadian Bond Fund) returned -0.80% in the quarter which was behind the FTSE Canada Universe Bond Index return of 1.56% The Fund was negatively impacted by spread widening and the flight to quality. While high quality government guaranteed National Housing Association Mortgage Backed Securities, and AAA rated Canadian Bank covered bonds fared well, the fund was negatively impacted by its holding of corporate debt. It was an environment where investors shunned away from all investments except government bonds themselves. The fund was very proactive in the period and was able to take advantage of select opportunities that were presented in the market. The fund finished the quarter with a yield to maturity of 2.8% and a duration of 6 years. This compares very favourably to the index yield of 1.9% and duration in excess of 8 years.

Pembroke Corporate Bond Fund Commentary

The Pembroke Corporate Bond Fund (previously known as the GBC Corporate Bond Fund) returned -3.26% in the quarter which was slightly behind the corporate index return of -2.48% The fund was similarly negatively impacted by spread widening on the lower rated holdings. During the quarter, the fund did benefit from a tender offer for Xplornet warrants which came attached to Xplornet bonds several years ago. This transaction is scheduled to close in the coming quarter. During this volatile period, the fund sold higher quality positions in the portfolio to take advantage of significant opportunities. The fund ended the quarter with a yield to maturity of 6.3%, which is a significant increase from 2.8% at the end of the previous quarter. The fund is well positioned to benefit from the current market opportunities.

To learn more about how the portfolio management team has navigated this turbulent period, listen to a replay of our virtual lunch meeting focusing on fixed income.

BALANCED STRATEGIES – Q1 PORTFOLIO COMMENTARY

Pembroke Growth and Income Fund Commentary

The Pembroke Growth and Income Fund (previously known as the GBC Growth and Income Fund) is a balanced fund of funds holding the Pembroke Dividend Growth Fund (primarily Canadian and US dividend-paying small and mid capitalization growth equites) and the Pembroke Canadian Bond Fund holding primarily Canadian and US sovereign and corporate bonds. The fund declined (-16.3%) in the first quarter of 2020 largely driven by declines in the equity portion of the portfolio, while the custom benchmark (60% S&P/TSX Composite Total Return Index, 35% FTSE TMX Canada Bond Universe Index, and 5% FTSE TMX 91-Day Canadian Treasury Bill Total Return Index) declined (-12.3%), en excess return of (-3.8%). Equity returns of the fund were negatively impacted by fallout from the COVID-19 pandemic. At the end of the first quarter, the fund held 62% of its assets in equities and 32% in bonds. Approximately 88% of fund’s assets were invested in Canada, 6% in the US, and 4% in Europe.

The fixed income portion of the fund, represented by the Pembroke Canadian Bond Fund, also declined in value during the first quarter. While bond markets experienced less severe fallout from the coronavirus crisis than equity markets, returns were still negatively impacted as credit spreads widened in response to a greatly diminished economic outlook.

Income in the balanced fund is generated from a combination of dividends and interest. The equity portion of the fund has a current annualized gross yield of 3.8%, while the fixed income segment of the fund is primarily invested in securities rated “A+” that, on average, have a collective yield to maturity of 2.8% and an adjusted portfolio duration of 6.0 years. The asset mix of Pembroke’s balanced mandates did not change materially through the year, with approximately 32.8% of the portfolio invested in fixed income securities at March 31, 2020.

Pembroke Global Balanced Fund Commentary

The Pembroke Global Balanced Fund (previously known as the GBC Global Balanced Fund) is a fund of funds that invests primarily in Pembroke-managed equity and bond funds, externally managed active funds, and externally managed passive funds and exchange-traded-funds (ETFs). During the quarter, the fund declined approximately (12.4%) compared to its custom reference benchmark (30% Canadian Universal Bond Index, 45% MSCI All-Country World Index, and 25% S&P TSX Composite Index), which declined (11.3%). The fund’s international equity allocation recorded excess returns versus its benchmark during the quarter while the Canadian and US equity allocations and the bond allocation underperformed their benchmarks during the quarter.

While the fund underperformed its custom benchmark during the quarter, the relatively shallow drawdown during the period reflects the benefits of diversification by asset class, by region, by factor (small cap and large cap), and by fund type (active and passive). At the end of the quarter the fund had a 70.4% allocation to global equities and a 29.6% allocation to Canadian corporate and sovereign bonds and cash.. The fund benefitted during the quarter from the decision to reduce equities toward the lower end of the target corridor at the beginning of the quarter. The bond allocation is largely to the Pembroke Corporate Bond Fund which was negatively impacted by its relatively short duration and the spread widening on some of its holdings. At the end of the quarter, the corporate bond fund had a yield to maturity of 6.3% and its low duration will position it well should rates rise from their historically low levels.

Please note that the names of the Fixed Income and Balanced funds have changed to unify the Pembroke and GBC brands. All funds now start with Pembroke, and the pooled funds for accredited investors include the word Pooled.

The GBC Canadian Bond Fund is now called the Pembroke Canadian Bond Fund.

The GBC Corporate Bond is now called the Pembroke Corporate Bond Fund.

The GBC Growth and Income Fund is now called the Pembroke Growth and Income Fund.

The GBC Global Balanced Fund is now called the Pembroke Global Balanced Fund.

Virtual Lunch Series

Managing Portfolios During Uncertain Times

As we continue to share our insights while maintaining appropriate social distance, we invite you to join us for a virtual lunch, (Mis) Behaviour In Times of Stress, on Wednesday, April 15th at 12:00PM Noon (Eastern Daylight Time).

An invitation with details was sent out by email, if you did not receive a copy and wish to join our virtual lunch, please contact your Pembroke Representative for details.

If you missed any of our Pembroke Virtual Lunch Series, you can replay our virtual lunches here.

Just the Facts

Top Five Canadian & US Holdings

Top Five Canadian Holdings

| Ticker | Company | Price Change (CAD) | Revenue Growth, Current Fiscal Year | EPS or EBITDA Growth, Current Fiscal Year | Revenue growth, next fiscal year | EPS or EBITDA growth, next fiscal year |

| KXS CN | Kinaxis | 9% | 16% | -14% | 18% | 32% |

Top Five US Holdings

Source: Bloomberg consensus estimates, some of which are under review.

Business Update

Pembroke is operating without interuption

Pembroke is operating without interruption even as we work from home. The investment team, the client service team, and the operations team are all employing technology to ensure efficient communication between colleagues, our clients, the companies we invest in and our service providers. As an essential service, we remain fully operational and available to assist as we always have.

While the situation continues to change rapidly and the markets remain volatile, we have increased our level of digital communication. In addition to this new digital format of the Pembroke Perspectives newsletter, we have hosted several conference calls on the topic of managing portfolios during uncertain times.

As previously announced, we are changing the names of several of our funds to unify the Pembroke and GBC brands. Going forward, all references to GBC will be replaced with Pembroke and the pooled funds for accredited investors include the word Pooled. The GBC American Growth Fund will, for example, become the Pembroke American Growth Fund. There will be no change to the underlying strategies of the funds as a result of the name changes.

During early April, the Pembroke Concentrated Fund was converted from a pooled fund into a mutual fund. This change allows all investors to have access to this strategy.

Disclaimer

This report is for the purpose of providing some insight into Pembroke and the Pembroke funds. Past performance is not indicative of future returns. Any securities listed herein, are for informational purposes only and are not intended and should not be construed as investment advice nor is it a recommendation to buy or sell any particular security. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Pembroke seeks to ensure that the content of this document is correct and up to date but does not guarantee that the content is accurate and complete and does not assume any responsibility for this. Pembroke is not responsible for decisions or actions taken or made on the basis of information contained in this document.

Publication Date: April 21, 2020