March 2024

Pembroke recently received an assessment report on its progress in applying the Principles for Responsible Investment (PRI). This assessment, covering the period up to the end of 2022, highlighted three critical areas: policy, governance and strategy; listed equities (active fundamentals); and confidence building measures, the latter of which is new.

Overall, we are pleased with our progress, particularly in the area of listed equities, where we received four stars out of five. This progress underlines our efforts to embed sustainability throughout Pembroke’s investment framework. This encompasses the integration of sustainability principles into our investment decision-making, as well as the firm’s own carbon footprint.

When it comes to our footprint, we take an annual inventory of all business travel. In 2023, we saw a significant increase in business travel compared to 2022, as it was the first full year of “normal” conditions since the pandemic. However, compared to 2019, air travel is still almost 30% lower.

Pembroke also recently carried out a survey of its employees’ commuting habits. Commuting is another way in which companies and their employees contribute to CO2 emissions. Understanding our collective habits helps raise the organization’s awareness of the need to reduce emissions and guides the firm as we consider ways to do so.

Carbon Footprint

One of Pembroke’s key investment criteria is that a company should deliver sustainable growth in earnings per share. This growth consideration means that our portfolios typically have significant weighting in Information Technology, Consumer Discretionary, Healthcare, Financials and, more recently, Industrials.

Two sectors that tend to be conspicuously absent from our portfolios are Energy and Utilities. Many, if not most of the companies in these sectors have large carbon footprints, while lacking an attractive profile of sustainable earnings growth. In the Energy sector, demand for oil and gas will not disappear overnight. However, the industry faces significant growth headwinds from efforts to reduce emissions. Oil and gas producers also have a history of relatively poor capital discipline, resulting in weak returns on invested capital.

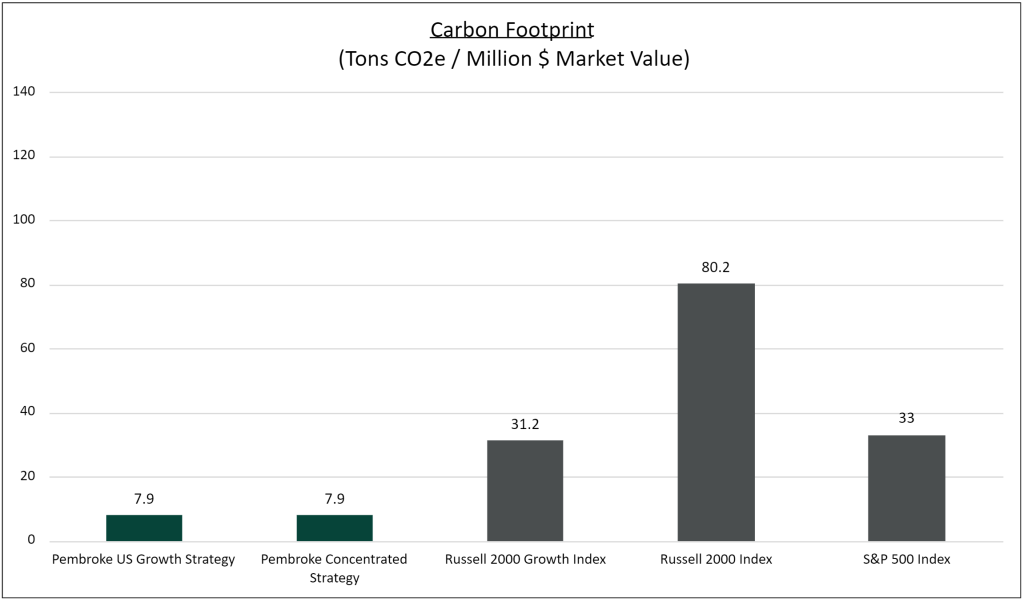

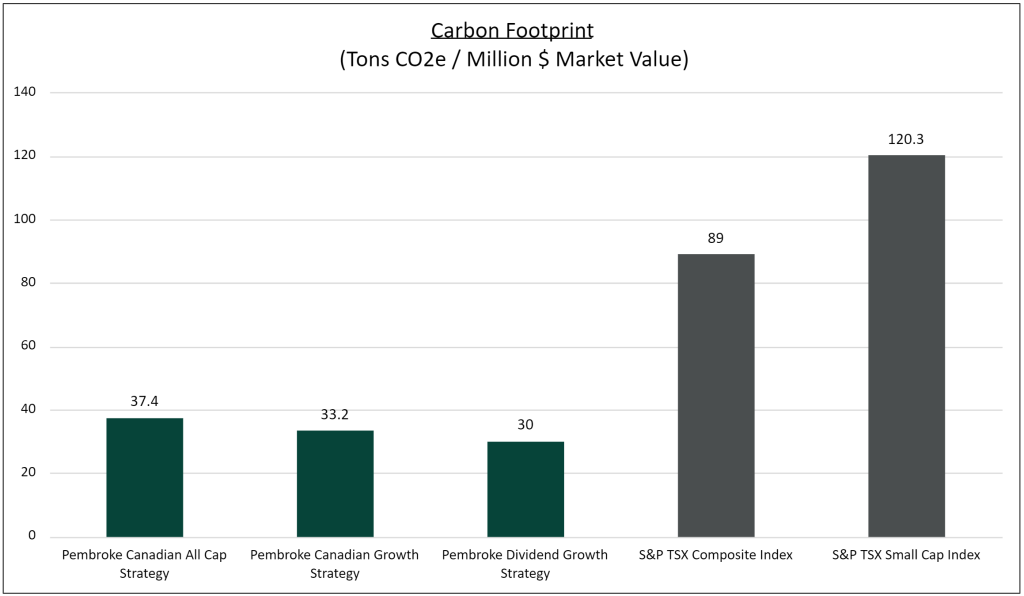

All of Pembroke’s internally managed equity strategies have carbon footprints well below their relevant benchmarks. This means that a client’s carbon footprint from investing in Pembroke strategies is significantly lower than if they were investing in a passive strategy that tracks the index (usually in the form of an ETF).

Carbon footprint refers to the total direct and indirect carbon emissions of the companies held in a portfolio. It is expressed in tons of CO2 per million dollars of portfolio market value. For our Canadian strategies, our investor’s carbon footprint ranges from 34% to 42% of the larger cap S&P TSX Composite Index. The Pembroke US Growth and Concentrated strategies have carbon footprints of less than 10% of the Russell 2000 index, the primary benchmark. Even the tech-heavy S&P 500 has a carbon footprint four times that of the Pembroke US strategies.

As we move forward, we remain dedicated to delivering value to our clients, while upholding our responsibility to the planet and future generations. We recognize the journey towards full sustainability is ongoing, and we are committed to continuous improvement. This commitment also embodies our belief that responsible investment is not just a choice, but a necessity for long-term success.

Other Articles Of Interest

Disclaimer

This report is for the purpose of providing some insight into Pembroke and the Pembroke funds. Past performance is not indicative of future returns. Any securities listed herein, are for informational purposes only and are not intended and should not be construed as investment advice nor is it a recommendation to buy or sell any particular security. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Pembroke seeks to ensure that the content of this document is correct and up to date but does not guarantee that the content is accurate and complete and does not assume any responsibility for this. Pembroke is not responsible for decisions or actions taken or made on the basis of information contained in this document.