EXECUTIVE SUMMARY

- In this paper, we tackle a common pitfall that can undermine diversification and highlight the many ways that investors can achieve successful diversification.

- A common mistake that unravels a successful diversification plan is trying to time markets by moving money in and out of asset classes, regions, or style groups in anticipation of performance changes or in reaction to past performance.

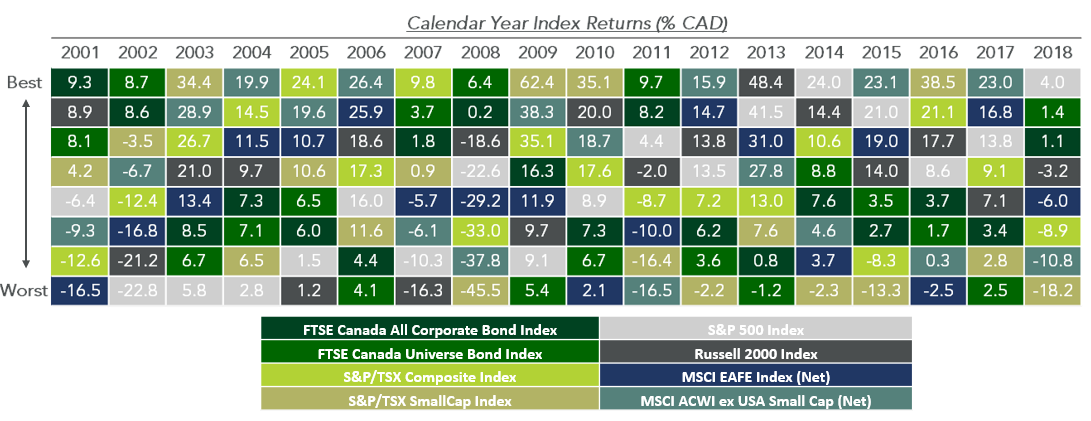

- Investors who chase performance risk selling under-performing asset classes just before they turn higher and buying out-performing asset classes just before they turn lower. This practice can not only damage returns, it can result in a portfolio that is frequently inconsistent with the investor’s long-term strategic asset allocation.

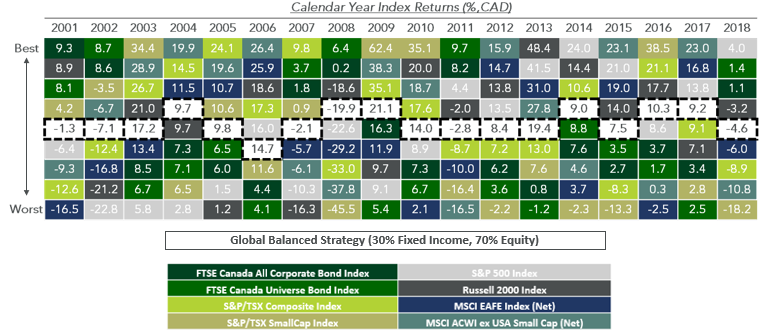

- Portfolios that are diversified across asset classes, regions and investment styles can work in investors’ favour as diverging performances offset each other to lower volatility. Disciplined rebalancing – adding and reducing exposure when asset classes fall above or below a target threshold – takes the emotion out of buy/sell decisions and maintains a portfolio’s strategic asset allocation.

- In addition to diversification across assets, regions and styles, diversification across investment managers is sensible; not only because of the diversifying idiosyncrasies and varying performances that different managers will contribute, but because a single manager may have a manager-specific event such as the departure of a key investment professional.

- Another element of diversification is the time dimension. Regular contributions boost the compounding effect in a growing portfolio by adding regularly to the capital that is being compounded and diversifying the points of entry systematically across market or business cycles. Regular contributions can be a tax effective way to rebalance.

- Pembroke offers The GBC Global Balanced Fund (“the Fund”) as a diversified, systematically rebalanced vehicle to pursue long-term capital appreciation and income in global capital markets. The Fund provides low-cost exposure to global large-cap equity markets, the pursuit of excess returns in small-cap and emerging-equity markets, and income from Canadian corporate and government bonds. Please contact your Pembroke Private Wealth Management representative to learn more.

New ideas, old problems

Innovation is about new ideas. Sometimes, innovation means looking at old problems with new tools. Other times, innovation means looking at new applications for existing tools. Take the case of portfolio diversification – this is not a new topic. At the time of Pembroke’s 25th anniversary, in September 1993, our GBC investor letter featured the article GBC on Asset Mix which highlighted the “need to diversify” and the “plethora of new products” that “extended the range of mutual fund investment”. While the number of investment innovations and new investment products since 1993 has exploded, some of the investors using them are not building wealth. The reality in 1993 and today is that investment products and innovations only become investment solutions when wealth management firms and their clients work together to build reasonable portfolios to meet long-term objectives.

Putting it all together – The GBC Global Balanced Fund

Pembroke offers The GBC Global Balanced Fund to create a diversified investment vehicle for our clients. The fund is a single vehicle that pursues long-term capital growth and income while diversifying across assets, geographies, investment managers, and market capitalization. The fund’s asset allocation is targeted to be 70% global equities and 30% Canadian fixed income with 80% active and 20% passive exposure. By creating rebalancing corridors for each asset class, we maintain the fund’s strategic asset allocation, increasing exposure to underperforming asset classes while reducing exposure to outperforming asset classes. The systematic approach to rebalancing takes emotion out of the equation and keeps the portfolio diversified at its targeted strategic asset allocation.

Conclusion

Despite the innovation and the abundance of new products in the investment management industry, many investors experience sub-optimal results by trying to time the markets. Pembroke recommends an alternative approach – diversifying across asset classes, regions and styles, rebalancing systematically, and contributing regularly. To execute this strategy, Pembroke offers the GBC Global Balanced Fund – a diversified global fund that combines stocks and bonds, active and passive management, and diversification across regions, market capitalizations, and investment styles. Please contact your Pembroke Private Wealth Management representative to learn more.

Disclaimer

This report is for the purpose of providing some insight into Pembroke and the GBC funds. Past performance is not indicative of future returns. Any securities listed herein, are for informational purposes only and are not intended and should not be construed as investment advice nor is it a recommendation to buy or sell any particular security. Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Pembroke seeks to ensure that the content of this document is correct and up to date but does not guarantee that the content is accurate and complete and does not assume any responsibility for this. Pembroke is not responsible for decisions or actions taken or made on the basis of information contained in this document.

Publish Date: November 7, 2019

1The GBC Letter, News and views for investors, Vol 2, No. 1, June 1993, page 2.

2Beginning with 2001, the first year for which annual, year-over-year return data was available for the S&P TSX Small Cap Index

3Two bond indices and six stock indices: Canadian bonds (both corporate and universal bond indices), Canadian stocks (both all-cap and small-cap indices), US stocks (both large-cap and small-cap indices), and international stocks (both all-cap and small-cap indices)

4The term “balanced portfolio” here refers to a portfolio balanced between two or more asset classes, such as stocks and bonds.

5Rebalancing refers to systematically buying and selling funds in order to maintain a target asset allocation, e.g.: 70% equities and 30% bonds.